Let’s do a quick update for the ZTM portfolio. If you’ll remember, this is a portfolio I started back in February 2019 to show that anyone can go from zero to a million dollars in the stock market.

The idea is to invest a small amount each month into one or two quality stocks. I detail all the rules here and so far the strategy has been going well.

What Happened In Q2 2020?

If we turn back the clocks to April 2020, the stock market was in turmoil and experiencing one of the sharpest drops in history.

The coronavirus pandemic was starting to spread at an alarming speed and economic data was beginning to show a severe global contraction.

At the time, many pundits were calling for heavier losses in the stock market. Warren Buffett sold his airline stocks and the predominant feeling was to sell not buy. Little did anyone know that the stock market was about to make a significant recovery led by tech and internet stocks.

Fortunately, we stuck to the rules of the ZTM portfolio which is to invest regular amounts each month.

Since I had put aside extra cash in previous months we were in a great position to invest heavily towards the end of March and beginning of April.

As I mentioned in the last Q1 update, we made a large number of trades in March and they ended up paying off for us through Q2.

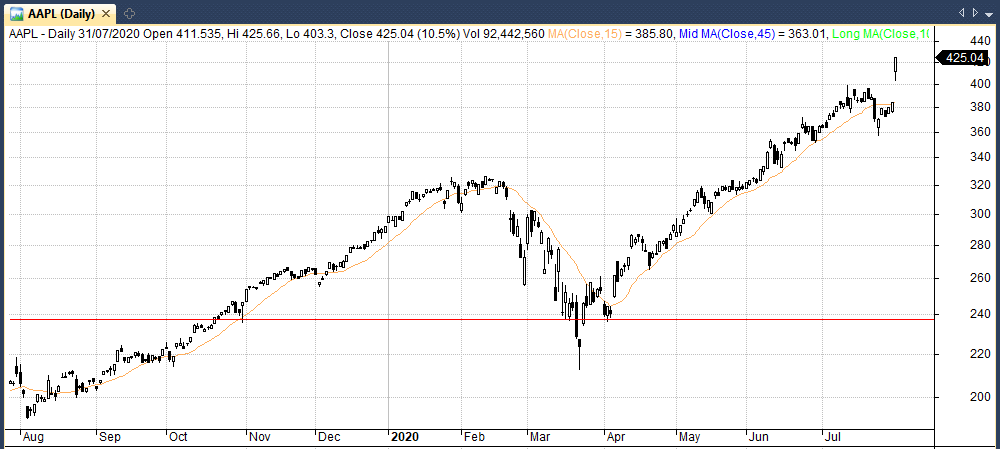

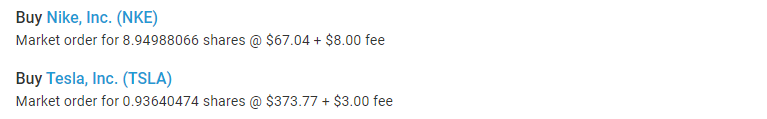

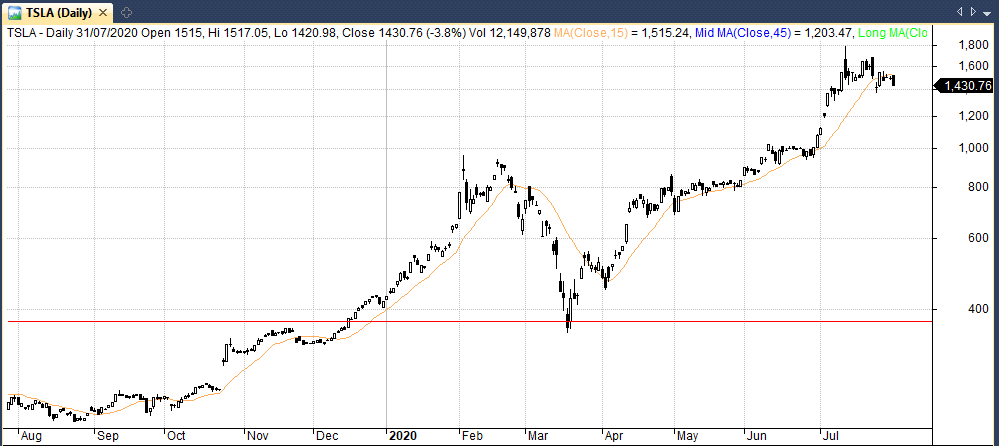

Trades in Tesla at $374 and $484 per share, Nike at $67 per share and Apple at $237 per share were particularly well timed, even though they seemed risky at the time.

As for trades in Q2, we were slightly less active, choosing to top up positions in AMZN, GOOGL and BABA while also purchasing some new positions in COST, ABBV and MLHR.

Top up positions in AMZN and BABA continued to pay off for us while COST, MLHR and ABBV are yet to make any substantial move higher.

What Went Right In Q2

Looking back it’s clear that investing heavily during the peak of the market meltdown was the correct thing to do and those moves bore fruit in Q2 as the market made a significant and unexpected recovery.

Although we were quite aggressive early on we also did not go overboard or try and make a quick dollar from the increased volatility.

As we moved through Q2, we continued with our approach and only invested in quality companies according to our rules.

It’s easy to say in hindsight that March was a great time to invest but the reality is that at the time, there was a huge amount of uncertainty. Markets could have easily dropped another 20%.

Thankfully we stuck to our plan of regular investment and that drove the portfolio forward in Q2.

What Went Wrong In Q2

Overall, we were pretty consistent in Q2 and did not make too many mistakes. It would have been nice to have been a bit more aggressive in some tech names at the beginning of the quarter. And I did take 40% of our profits on Tesla at $800.

However, I’m generally quite pleased with how events panned out.

Some Thoughts On Tesla

As mentioned already we did make a small purchase of Tesla. I know Tesla is a hot topic among investors so I thought I would share some of my own thoughts.

Although I have been relatively cold on Tesla in the past, my criticism has mainly been due to the excessive valuation of the stock and the high costs and failure rate associated with the auto industry – rather than anything specific to the company itself.

So when the stock price dropped under $500 I knew that there was a decent risk:reward opportunity on offer and I was more than comfortable taking a 5% position.

While we hear a lot about Tesla’s ability to dominate the EV market and it’s progress in automated driving and solar, what isn’t talked about so much is the strength of the Tesla brand.

My thinking on Tesla has significantly warmed and I feel that they are building one of the strongest consumer brands in the world. In my eye, Tesla is becoming a brand of prestige that consumers want to be associated with and I think that is a big plus.

Whether or not it will help Tesla become a trillion dollar company, I’m not so sure. There is still a lot of uncertainty and a long way to go but as I say I was more than happy to buy some shares under $500.

Q2 Performance Roundup

Despite a difficult period and a lot of volatility I’m more than pleased with how ZTM performed through Q2.

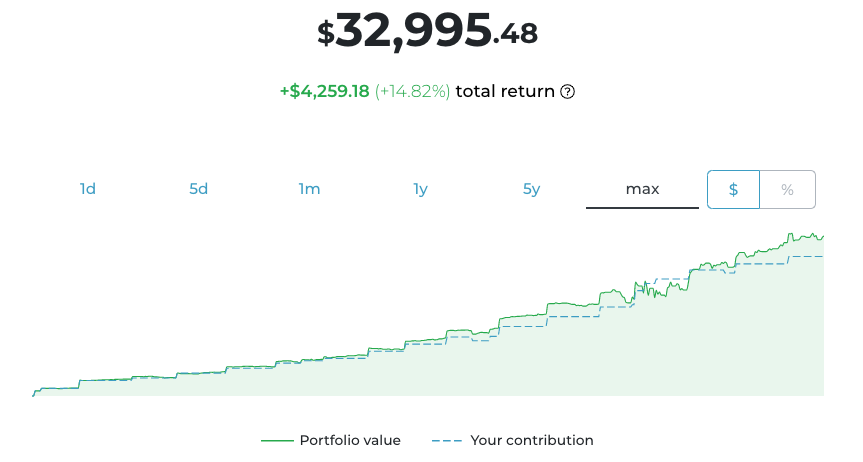

We started this project in February 2019 at zero and as of 30 June 2020 our total capital stood at $32,995.48 for a total return of +14.82%.

By comparison, if we had invested the same amount into the S&P 500 ETF each month our account would now be at $30,608.76 for a total return of +6.52%.

So we are still beating our benchmark and proving that it is possible for regular investors to beat the market by picking individual stocks.

Looking Ahead

Looking ahead, I’m becoming more and more uneasy about how certain stocks are advancing despite the rising rate of infections and poor leadership from governments.

There is a high risk that the virus will escalate further in the fall causing more jobs to be lost and continued economic pain. Furthermore, the huge stimulus from governments is likely to be a long term drag on economic growth.

Tech stocks like AAPL, AMD, SHOP, W look like they have run too far and I would not be surprised to see a significant pullback as we move into Q3 and Q4.

As a result, I am once again going to move into a defensive stance and put some cash aside instead of investing the full allocation until the condition improves. In my eyes there are some good short opportunities in this environment.

It’s going to be an interesting time. But by following the ZTM system we should continue to do well.

If you would like to learn more about the Zero To One Million portfolio I have detailed the full strategy here.

Yes , that was a great Article overall. Position Cost Averaging is a Great Strategy when the Markets are Trending. That means they are moving in one direction – which is up. However , we are entering uncertain period for the Markets & economy (virus related) going forward . We still don’t have a reliable vaccine (side effects free) to stop the virus from spreading and we are entering historically volatile period before Christmas Rally (most of the times) . So yes , It is a good idea to bag some profits in now.

When it comes to Tesla , they had a great run along with other high flyers . But I can’t not notice that all those big Company Stocks that made huge gains since march dip were Tech Stocks . And Tech Sector is still on fire. There is an opinion on the Web, that Tesla is more of a tech than a car company . Toyota recently admitted that Tesla’s AI Motherboards are so advanced , that they need 6 years to figure this thing up . So they are ahead 6 years of the competition. Besides that , Musk personally mentioned that his goal is to achieve a combined Energy : Production,Distribution and Storage Globally . Since he was successful in the space , cars , energy storage and production , i would not bet against that. A lot of Shorts were burned recently ! Still ,Tesla was , is and probably will be a volatile stock so you really need a good stomach for that.

So overall , this article touched many topics that are on everyone’s mind right now. Great read .Thank You.

Cheers mate, appreciate the comment. I’m convinced we are headed for a rocky patch but we will see.