You’re probably aware of how difficult financial trading can be and how much luck plays a role in results.

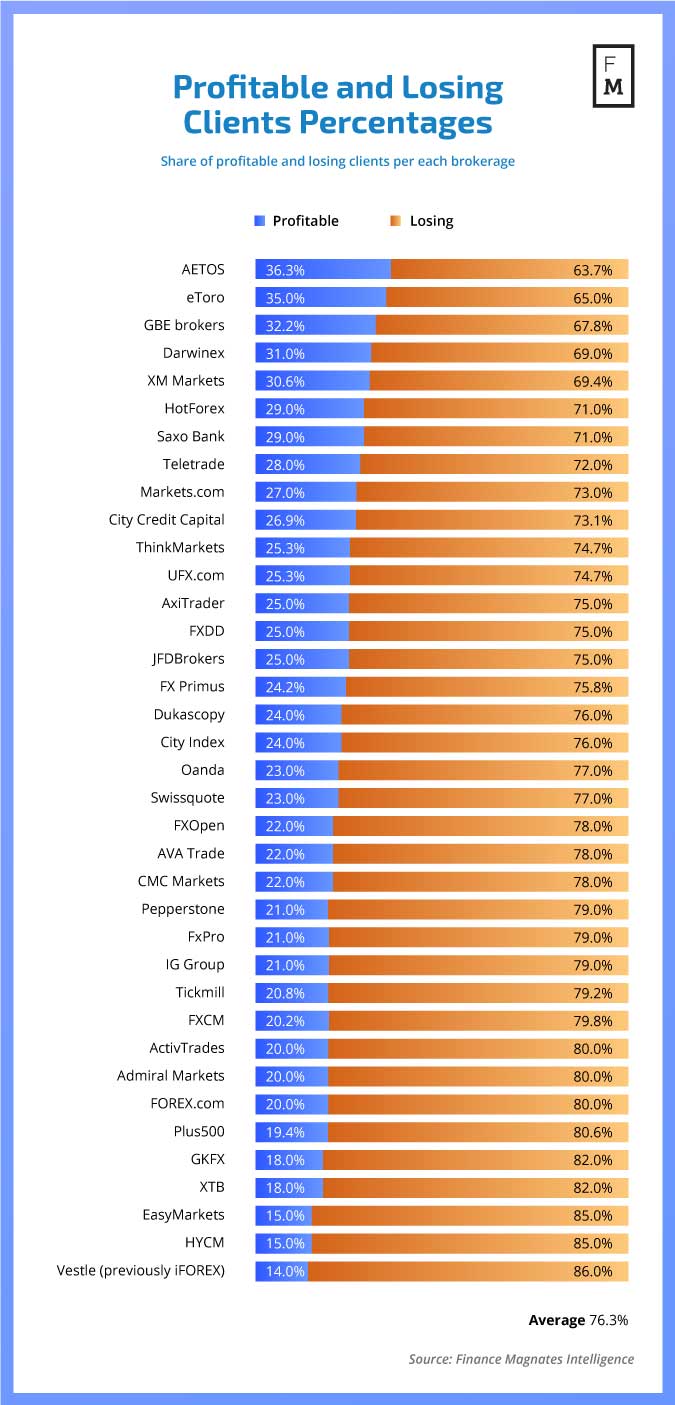

Latest figures from Finance Magnates show that in the year up to August 2017, 76% of CFD traders lost money.

As shown by the graphic below, some brokers were better than others:

But it gets worse.

If you extrapolate those numbers out for another year and assume that 76% of those initial winning traders lose in year two, you end up with a figure of ~94% of traders losing over two years.

Of course, this assumes the winning traders don’t have a concrete edge. Some will.

However, it is equally true that the edge of some profitable traders will be based on a market cycle such as being in a bull market.

But, financial trading can be profitable for those with skill, dedication and discipline.

Later in this article I will provide my best advice for making the jump to being an elite trader among those who are making consistent profits.

But before I do, I want to say a word about conservative investing. Since not everyone can be a winning trader, conservative investing is your best chance to build long lasting wealth.

In other words, it has a much higher chance of success than day trading or swing trading.

Conservative Investing Rules

The first thing I want to say is that you should always make some room for conservative investing no matter what stage you are at or what your financial goals are.

The unfortunate truth is that not everyone can beat the market. So if your only focus is on getting rich quick you run the risk of underperformance or even losing money.

Even if you are a good trader, don’t make the mistake that long term investing is not for you because it could save your skin one day when trading gets tough.

That edge you’re trading now might not last forever so it would be good to have something to fall back on.

Equally, if short-term trading is not working out for you don’t beat yourself up. As we have seen, most of those who attempt to trade will fail and there are numerous good reasons why. (Front running, being just one.)

Instead, read up about personal finance and stick to these four investing steps:

- Pay off high interest debts first. This is important because there are very few investments in this world that are going to trump your 30% credit card fees.

- Save more than you spend. This is the most important rule and has helped thousands of everyday people to achieve a good standard of living.

- Invest regularly into the market using a simple dollar cost averaging approach. You can use low cost ETFs such as SPY, VOO, VTI, TLT etc. to get diversified exposure to stocks and bonds. You don’t need anything fancy.

- Stick to the plan and don’t attempt to time the market. Simply rinse and repeat this process and don’t get sucked into the swings and prophecies of the market. Keep saving and keep investing.

If you keep to those principles you can build up a solid nest egg with a portfolio bought at ‘average’ prices.

It’s not glamourous but it’s effective and the more you can save and the more you can invest in this approach, the better you will do.

Short-Term Trading

Now when it comes to short-term or medium-term trading it’s important to think differently. I’m not saying you shouldn’t trade, far from it.

I’m saying that you should take care of your savings first and only trade with so-called ‘leisure’ money at first.

It makes sense to start small and scale up when you have success.

For example, you could use 90% of your money for conservative investing and then 10% for short-term trading. Then scale up accordingly.

But before you do, remember who, and what, you are up against.

Beating The Algos

Like any competitive game one of the most crucial components for success is understanding your opposition.

In the financial markets algorithms now make up a large part of the landscape. So it is essential that you know how these algorithms work and the markets they play.

Of course, one problem is that algorithms are getting smarter all the time.

In 1996, the super computer Deep Blue beat the world’s best chess player.

In 2016, AlphaGo beat the world’s best Go player using artificial intelligence.

So how can you compete?

The best way to beat these machines is to team up with them. In other words, a human player with a computer is far better that a computer on it’s own.

A computer excels at finding patterns quickly, processing data and executing without emotion. But only a human brain can understand the complexities of dynamic systems like financial markets.

It’s also important to stay away from the hype.

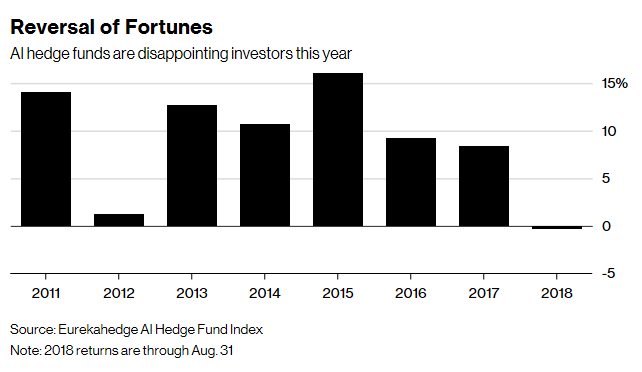

As the chart below shows, despite all the hype around artificial intelligence and machine learning, these hedge funds are still having a hard time:

My Best Advice

So when it comes to trading, my best advice is to find yourself a strategy which you can ‘team up’ with and use as a base.

Study that strategy with intensity. Keep with it until you gain an intuitive feel for how it works.

What are its strengths? What are its weaknesses? How can you work alongside the model? How can you improve it?

What Type Of Model?

The best part is that it doesn’t particularly matter what type of strategy you choose.

You could choose a day trading system. A trend following system. A pullback system. You could even choose a value investing approach.

As long as you can track your chosen strategy and it makes sense to you.

It doesn’t even need to be crazy profitable. Many hedge funds and high frequency firms operate with less than a 1% advantage.

The important thing is you begin with a profitable edge. That immediately gives you a head start.

You can then work with that small edge in order to build a framework for consistent, profitable trading.

Remember that most retail CFD traders are not working with a system. They are trading based on their instincts with no discipline whatsoever.

Don’t Trade Blind

And it is discipline in executing your strategy that will take you much further than most.

In my experience, trading without a system backed by data is like trading blind. It is very hard to do and leaves a lot up to chance.

You will go a lot further by starting off with a profitable system and working alongside it. You will learn when the system does well and also when to turn it off.

You will learn which systems to avoid and which to follow more closely. You will learn what markets to avoid and how to size your bets appropriately.

This is very hard to do without analysing and backtesting your ideas.

A human with a computer is far superior to a computer on its own and a human with a trading system offers the best chance of success.

And remember, if all else fails, don’t forget about conservative investing.

I assume these figures are after commission? I figure that I pay almost four percent in commissions every year. It sucks but unfortunately we don’t have a choice here in retail…

Yes I assume so.

Commissions take most of the gains from Trading. Always prefer investing rather than trading.