Today’s trading edge is to go short GBTC stock (ticker symbol for the GBTC Investment Trust) and go long bitcoin in order to profit from the substantial spread between the two products.

This spread is predicted to close once Bitcoin futures go live on the CBOE and CME futures exchanges in a few days time.

What is GBTC?

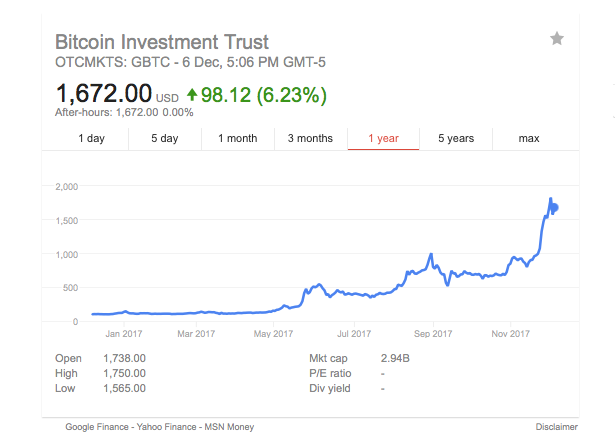

GBTC is the ticker symbol for the Bitcoin Investment Trust. It’s described as an open-ended grantor trust and it’s sponsored by Grayscale Investments.

The trust is fully invested in bitcoin and the objective is for the fund’s NAV (net asset value) to track the bitcoin market price. Thus it allows investors exposure to bitcoin without having to buy the cryptocurrency directly.

What is the GBTC NAV?

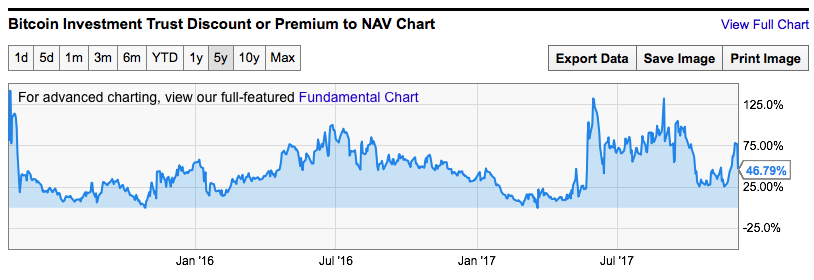

However, as you will see from the chart below, GBTC has done a very poor job of tracking bitcoin and has continued to sell at a significant premium to the underlying market price of BTC.

Furthermore, you can see that this premium has fluctuated wildly over the last year. In short, if you wanted exposure to bitcoin, then GBTC has been a pretty poor choice:

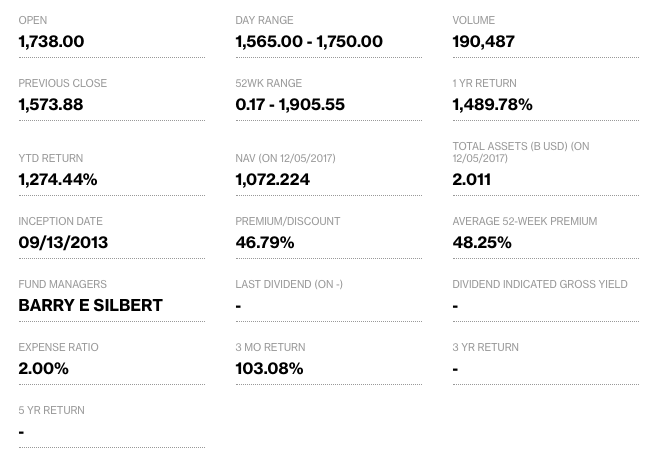

As of today, Bloomberg shows that GBTC NAV is currently trading at a premium of 46.79%.

This is still a very large spread and opens up the possibility of an arbitrage trade where you sell GBTC stock and buy bitcoin in order to profit from a closing of the spread.

GBTC Vs. Bitcoin – The Trade

Today’s trade idea is to short GBTC and buy an equivalent amount of bitcoin while GBTC continues to trade at a significant premium.

Bitcoin futures are scheduled to open up on 11-12 December and that should see a significant change to market structure and introduction of liquidity.

Andrew Left from Citron Research predicts that GBTC premium should close to at least 10% under this scenario.

This trade gives investors a great opportunity to lock in a profit from a spread of over 30% in just a couple of weeks time.

Obviously, the trade is not without its risks. Bitcoin is wildly volatile and there will be costs and difficulties associated with shorting GBTC. Many brokerages will not have shares available to borrow so traders may need to shop around to locate shares. But this could be an interesting play over the next few weeks.