Simple technical analysis is of limited use to long-term investors. Momentum can last for a long time but it doesn’t have much predictive ability on a five or ten year time horizon.

Likewise, indicators like moving averages or RSI are best suited for shorter-term trading.

With that said, you don’t know until you test. So in this article I download historical data for 7000 US stocks and analyze 22 different trading signals.

The aim is to see which trading signals produce the best long-term, 10-year returns.

Setting Up The Test

I’m going to test 22 different entry signals on US stocks and compare their average returns over a 10-year holding period. For example, what is the 10-year return following a new 52-week high or 52-week low?

The data for this analysis comes from Sharadar and is filtered to remove any stocks with an enterprise value (EV) of less than $100 million. The data also includes delisted stocks, dividends and transaction costs.

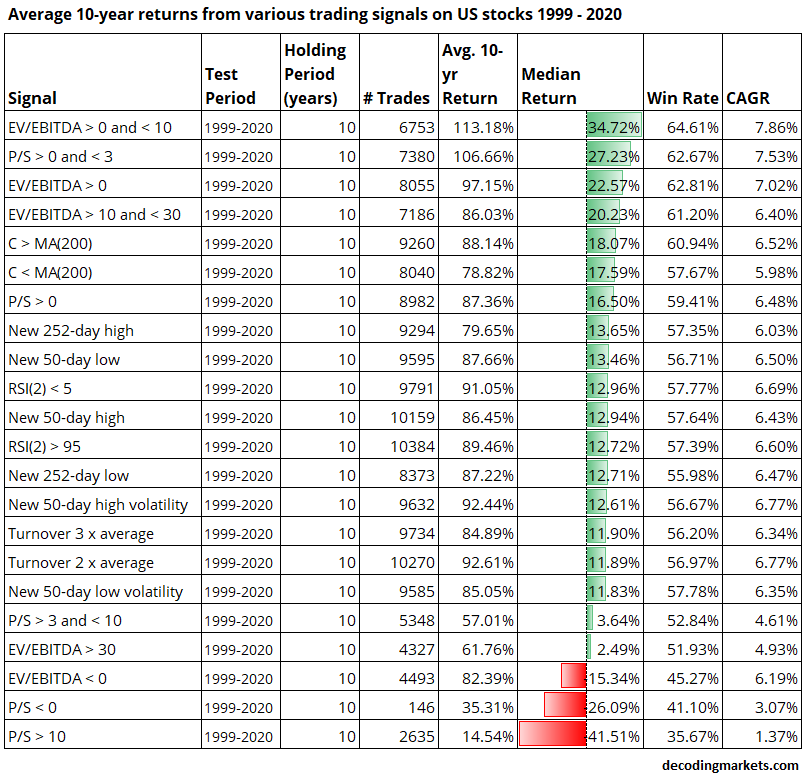

The table below shows our results and has been sorted by median return:

As the table above shows, the trading signal that produced the best 10-year returns was an EV/EBITDA score between 0 and 10. This signal produced the best average return (113.18%), best median return (34.72%), and best win rate (64.61%). It also produced the highest CAGR of 7.86%.

The second best trading signal was a price-to-sales (P/S) score between 0 and 3 which produced an average 10-year return of 106.66% and median return of 27.23%. The win rate was 62.67% and the CAGR was 7.53%.

Conversely, the worst trading signal was a P/S score over 10 which produced an average 10-year return of 14.54% and median return of -41.51%.

The second worst trading signal was a negative P/S score which produced an average return of 35.31% and a median return of -26.09%. This was a small sample of only 146 trades. (There aren’t that many companies with zero revenue or sales).

Technical Rules

Looking only at the technical trading signals, the best 10-year return came from a close above the 200-day moving average which produced an average return of 88.14% and a median return of 18.07%.

Meanwhile the worst technical trading rule was a new 50-day low in volatility which produced an average return of 85.05%, a median return of 11.83% and a win rate of 57.78%.

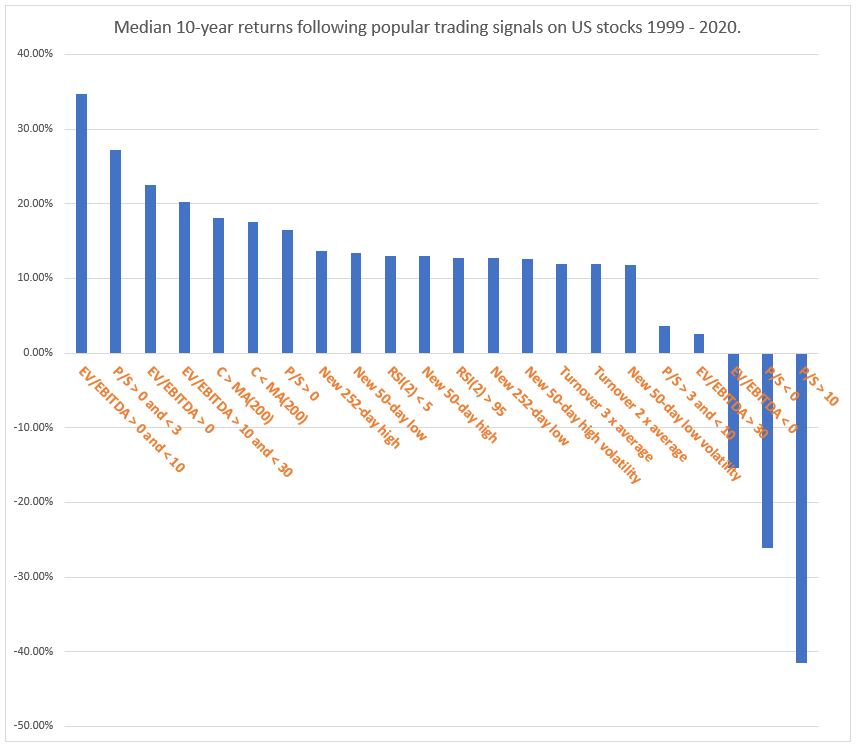

The following chart shows a visualisation of these results:

Initial Observations

What is interesting about these results is that the fundamental rules show some potentially predictive patterns while the technical rules are unlikely to be any better than random.

The analysis indicates that a low EV/EBITDA score is conducive to long-term returns but a negative score, or very high score, is not. This is logical since a negative EV/EBITDA score indicates a company with zero earnings. And a very high score indicates a company that is overvalued.

The same observation can be seen in the price-to-sales metric where the optimal score is somewhere over zero (indicating profitability) and below three.

Conversely, the technical rules seem to converge on one another and do not do any better than random (which was a median return of 18.28%). In fact, there is not a great deal of difference between the worst performing technical rule and the best performing technical rule.

Conclusions

In this article we tested a number of different trading signals on a large sample of US stocks to judge their impact on long-term returns between 1999 – 2000.

The results showed that low (but not negative) EV/EBITDA scores produced the best long-term returns and a similar finding was found for price-to-sales. This is a pleasing result since the two ratios share common ground.

Meanwhile, technical analysis rules did not show any significant pattern and probably do not have any predictive ability over a 10-year time horizon.

The 7.86% CAGR from a low EV/EBITDA score might not sound like much but it does beat the buy and hold return of 6.64% and is more than many investors achieved during this time period.

It’s also worth noting that this database of stocks is not filtered by exchange membership so it includes a number of smaller companies that never traded on a major index. This could significantly reduce the overall returns shown.

Final Thoughts

It would be foolish to buy a stock just because it has an EV/EBITDA score between 0-10 or a price-to-sales score between 0-3. And doing so is shown to produce only slightly better than average returns.

However, this analysis is useful because it gives us an idea as to what works over the long term and a direction to go in. As such, a low EV/EBITDA or P/S score could be included as just one input into a multi factor strategy – as a means of tilting the odds in your favour. Or, it could be used as an initial screen to filter out unprofitable or overvalued stocks.

So far, all the analysis I have seen indicates that stocks without earnings (and certainly without revenue) produce poor long-term returns. Such stocks could make good short opportunities. This is an important insight when dealing with many of the hyped up stocks that are frequently covered in financial media.

One last word of caution, however. This analysis doesn’t yet show how these results have altered over time and there is some evidence that value metrics like EV/EBITDA have lost their power in the last couple of years. This will be the focus of a future article.

Notes

Data used for this analysis comes from Sharadar and includes dividends and delisted stocks so as to minimize survivorship-bias. Results also include transaction costs of 0.05% per trade. Data excludes micro, nano, ADR stocks and stocks under $100m EV. Backtesting produced in Amibroker.

For the fundamental data, are you looking at trailing 12 months?

Yes.

You are including biotech and financials, right?

That’s correct.

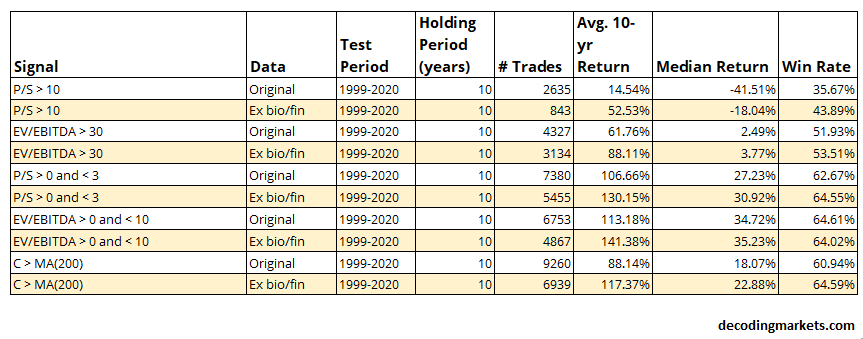

Since many biotechs have a huge P/S ratio, I am wondering how much the P/S signal results change if you exclude them from the test? E.g., are P/S > 10 stocks still massive underperformers outside of biotech?

Yes, good point. I didn’t think to filter by sector, will give it a look.

Hi Mark. I removed biotech companies and financials (except major banks) and did some more analysis. It seems removing these stocks improves results across the board. However, P/S over 10 still doesn’t look like a reliable indicator.

https://imgur.com/QZjCW7L

Yet another question, if you don’t mind….

Are you only counting trades that lasted a full 10 years? I.e., your last entry date was Oct 2010?

No, the code enters every trade and holds for 10 years or until the last good bar. Therefore the code still enters stocks in 2019 for example. I didn’t want to exclude stocks post 2010.

Got it. Thanks, and looking fwd to the next installment.

Curious as to the stocks you included in this dataset test and also the performance since 2020. I know at the beginning you mentioned 7000, but was it limited to a certain exchange like the Nasdaq?

7000 US stocks from both Nasdaq and NYSE. I haven’t checked 2020 or 2021.