If you read last month’s update you will know that I recently started a new investing portfolio called ‘Zero To One Million’.

This is a project where I am attempting to hit $1 million in equity through the process of investing a small amount (typically $1000 – $1500) into one or two different stocks each month.

This is a long term strategy that I have backtested extensively using a method that randomly selects stocks.

But instead of picking stocks at random I am using a part quant/part discretionary method that I hope will enable me to do much better than random.

I plan to publish a much more detailed guide that shows exactly how this strategy works.

For now, I will detail the one stock that I bought in September and my thoughts behind it.

What Happened In September?

I found September to be a tricky month to navigate. The S&P 500 spent most of the month close to record highs despite a number of worrying developments.

Because of this, I decided to deploy only half my allowance.

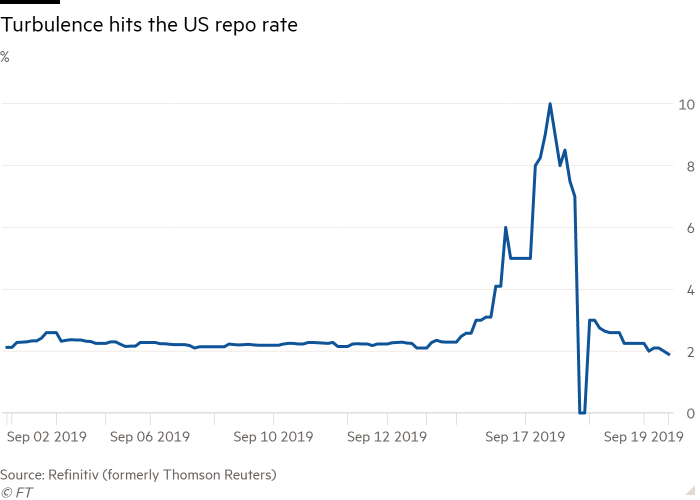

For me, the most worrying news concerned the US repo market with some money market rates hitting their highest levels since the financial crisis. This led to the Fed stepping in to inject funds:

Although there were technical reasons (tax bills) put forward for the surge, I am always concerned movements in money markets could be a symptom of wider problems so I was reluctant to put more money to work with this issue looming.

The second most worrying event was news that the US might stop the listing of Chinese shares on US exchanges.

Such an event is bound to have significant ramifications on the market and especially the Chinese shares that I have already purchased (BABA and FXI).

So, although I am not bearish per se, these two stories, along with the S&P 500 near record highs (and subsequent lack of investing opportunities), meant that I decided to make only one stock purchase in September.

I decided to put half my monthly allowance in Kroger and put the rest aside for a better opportunity in the coming months.

The Kroger Company (KR)

The Kroger Company is the largest supermarket and second largest general retailer in the US with 2,759 stores. It also operates over 1500 fuel centers and has been in operation since 1883.

I purchased some KR stock at an average price of $25.59, roughly a 20% discount to the 52-week high.

You can see from the chart that Kroger has been in a downward trend since 2016 and the business has seen some slowing earnings during this period.

Some of the poor price movement of the last couple of years can be put down to negative sentiment affecting bricks and mortar retail shops.

This is especially true with Amazon entering the groceries market after their acquisition of Whole Foods.

However, this has also left KR with a fairly attractive valuation of 8 times EBITDA and the stock is priced at 0.3 times yearly revenues.

Following are some stats that I’ve taken from the Seeking Alpha website as of 6th October 2019:

Key Stats

- Enterprise Value: 39.79B

- Revenue: 120.85B

- EBITDA: 5.15B

- P/E: 12.35

- EV/EBITDA: 7.72

- EV/FCF: 34

- PEG: –

- P/B: 2.28

- P/S: 0.16

- Gross Profit Margin: 22.43%

- ROE: 20.12%

- Total Debt/Equity: 238.31%

- Dividend: 2.58%

As you can see, Kroger trades at a valuation of $40 billion while yearly revenues are $121 billion and EBITDA is $5.15 billion.

The stock has healthy profit margins and debt-to-equity is manageable.

2nd Quarter Earnings Beat

Kroger also put in a decent second quarter with an earnings beat of ~7%.

There was also a good write up in the Financial Times about Kroger and how Amazon may not be as big a threat in the groceries market as investors think.

Amazon likes to try new avenues but it doesn’t always follow through if the profits aren’t there. Kroger (which is having success with its own online platform) may not be as affected as some believe.

There was also speculation that Kroger could offer a good merger opportunity with another big name in the industry.

A Long Established Business

Overall, Kroger meets my criteria of a strong business and I feel that fears over Amazon are overdone.

It is a long established business trading at a fair valuation and I expect the company to still be going strong in ten years time (if not merged with another player).

Kroger also pays a 2.58% dividend and balances out the tech stocks already in my portfolio. I also feel it could be a decent-enough stock to hold during a recession, which is possible given worrying market news.

I decided to purchase 19.5 shares at a price of $25.59.

September Performance Update

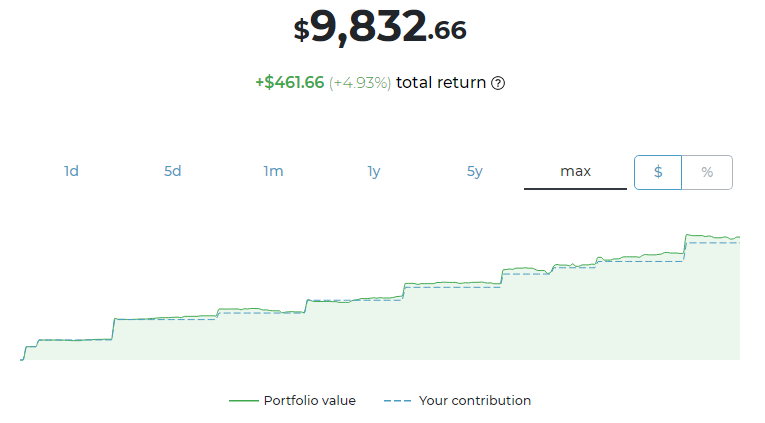

This has taken the total value of the portfolio to $9,832.66 and the total return (as of 6th October) is 4.93%. This is better than our benchmark return (monthly investing in SPY) of 2.33%.

The goal of this portfolio is to prove that anyone can become a millionaire by investing a small amount each month into long-term quality businesses. So far I’m pleased with how it’s going:

Well, cant stand for you to release the zero to one million details to know a bit more about that. I am interested in the half quant, half discretionary stock picking too.

The recent deal with china is probably going to release a bit the tension in the markets and maybe allow some upside in the stocks market (hopefully!).

See you next week and thank you for your comment.

Interesting idea I will follow with interest.