I came across the following quote on Twitter:

Unless you’re a perennial short seller, pessimism about the future is of no help. Only optimists make money in the markets.

D Mutukrishnan

Mutukrishnan has a great way of words and I think this quote is very true.

If you’re too pessimistic about the market you’re going to have a tough time making a lot of money.

And that’s because pessimism is rooted in fear and to make money in the markets fear needs to be conquered.

Fear stops people from doing what they should do, which is to put their money to work in high quality investments.

Because having your money working for you is one of the pillars of financial freedom.

There’s Always A Reason To Sell

Pessimists don’t put their money into stocks because they fear that the next big crisis is always around the corner.

Financial news is generally negative so there’s always some good reason to stay out of the market.

This week it could be a trade war or political unrest. Next week it could be oil prices or an inverted yield curve.

But these negative events happen all the time and they don’t necessarily stop the market going higher.

For example:

- In 1963, a year of civil unrest, conflict in Vietnam and the assassination of JFK, the market rose 19%.

- In 1980, a year of economic recession with inflation over 14%, the market rose 26%.

- In 2003, as US troops led the war on Iraq, the market rose 26.4%.

- In 2020, in the midst of a global pandemic and economic shutdown, the market rose 18%.

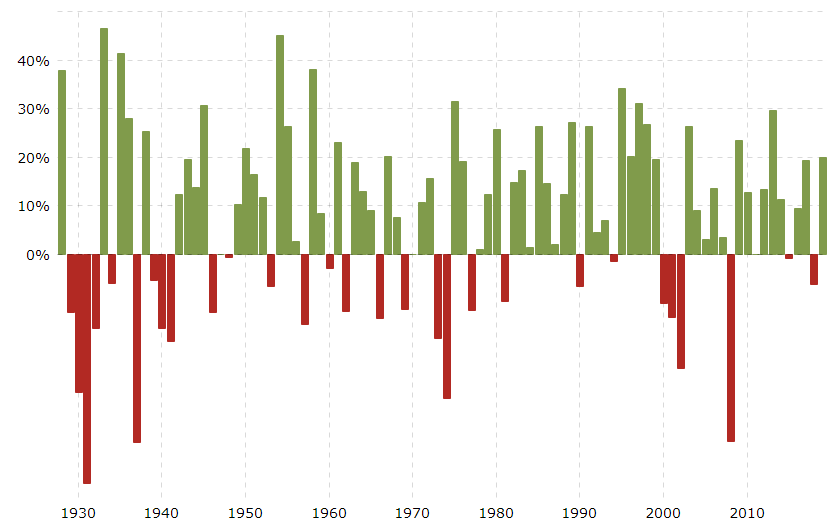

So whatever’s happening today, there’s always a reasonable chance (about 70% in fact) that large businesses will shrug it off and the market will carry on higher.

Bear Markets Do Happen

Of course, the upward trend in equities has also been punctured by vicious down moves, such as the ~70% drop during the great depression and the ~50% drop in 2008.

These events are real and very damaging to portfolio returns.

But despite these periods, the market still pays out its dividend and manages to recover.

And it’s not all bad. If you take a dollar cost averaging approach you can use down markets to buy a greater quantity of shares at lower prices.

My point is that there’s always some reason to get out of your investments but there’s only one reason that you shouldn’t – which is that investing in stocks is generally the right thing to do.

You Still Need To Be Diligent

That doesn’t mean you should put all your money into stocks without any care or due diligence.

Of course not.

It pays to do your analysis and to keep up with market developments. If you can avoid just one bear market in your lifetime it will make a big difference to your overall returns.

However, market timing is notoriously difficult and those who pick the turns too often can end up missing large chunks of upward price movement.

As Peter Lynch said:

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.

Peter Lynch.

And I see this so often.

People are constantly worried about a market crash. So much so, they miss out on huge bull markets. When they finally do enter the market it’s almost time for a reversal.

Markets Are Surprisingly Robust

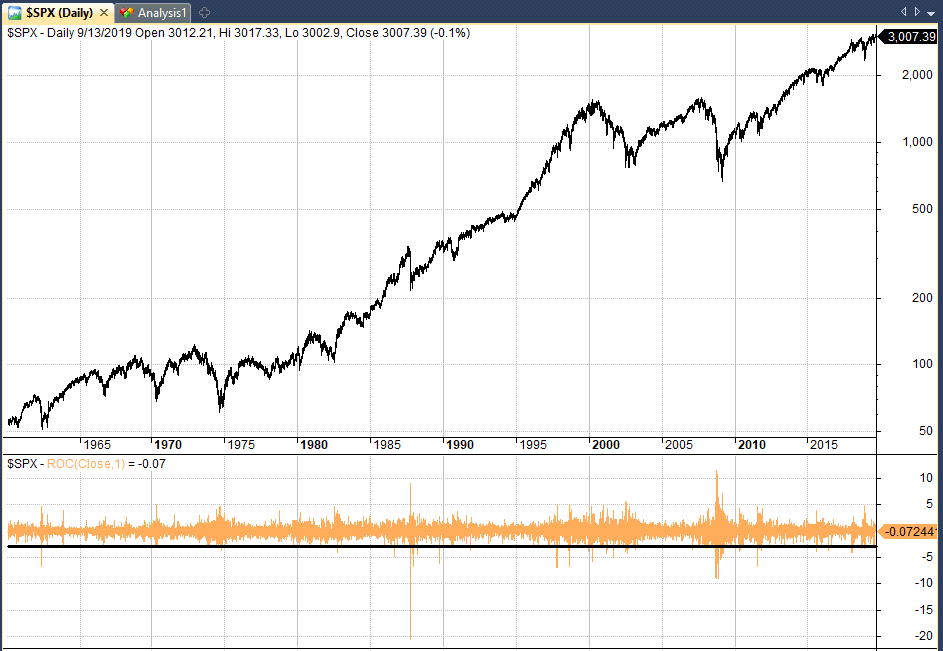

The truth is that markets are a lot more robust than people give them credit for.

Over the last 60 years, the S&P 500 has fallen more than 3% in one day on just 98 occasions, that’s 0.65% of the time. And it’s fallen more than 10% only once, in October 1987.

A typical normal distribution implies that approximately 68% of daily returns should occur within one standard deviation of the mean, but for the S&P 500 the actual number is closer to 95%.

At least in this one respect, the S&P 500 is surprisingly robust.

As someone who once tried to trade live horse races for a living, the stock market is tame.

Have Cautious Optimism

I’m not saying that you should never sell your position, hedge your portfolio or prepare for a bear market.

On the contrary. It is vital to be diversified and to have money in different assets and strategies.

Furthermore, if you understand the market and you can see there are problems brewing then you’d be foolish not to take action.

But don’t become too pessimistic on the future. No investor got rich without some optimism.

Scared money never wins in the long run.