If you have read some of my recent posts you will know that I’ve started a new portfolio called Zero To A Million.

This is a project where I am attempting to reach $1 million in equity by investing a small amount into the stock market each month.

This strategy is part quant, part discretionary and I describe it in detail here: Zero To A Million – One Stock At A Time.

The idea is to find one or two quality stocks or ETFs each month and build a $1 million portfolio in the quickest time possible.

It’s also to prove that you can make money investing in individual stocks and you don’t need to follow the crowd into index funds.

What Happened In November?

November was another tricky month with the S&P 500 moving to new highs and not many good opportunities to be found in quality stocks.

Because of this market strength, my first move in November was to rebalance a portion of my Apple shares which had risen around 44% since purchase and taken the portfolio weighting to over 30%.

I was not particularly keen to sell, however, the weighting of Apple in the portfolio was getting too large so I decided it was a good time to rebalance.

It may well prove to be a bad decision but I can live with it because shares cannot go up forever and must pullback at some point.

The rebalancing of Apple meant I had extra money to play with this month, however, I decided to put it aside for future opportunities instead of reinvesting it in November.

Disney (DIS)

The first purchase I made in November was Disney which I purchased at a price of $132.48 per share, adding to my previous position which I bought in February.

As luck would have it, the market liked Disney earnings on the 7th November and the stock jumped around 5% and has continued to move higher since.

Investors continue to be bullish on the chances of Disney+ and that is helping to ignite growth prospects in the company.

Personally I like Disney because it has a strong competitive advantage and excellent flywheel; content, theme parks, merchandise — everything works together to create a powerful money making machine.

For the purposes of the ZTM portfolio I think it is a good long-term stock to hold.

Alibaba (BABA)

The second trade I made in November was Alibaba which I purchased at a price of $186.91 on the 18th.

Alibaba is another stock that I already hold so this was another top up to my existing position. I spoke about why I liked Alibaba in August.

I was actually a bit unsure about this trade due to the tensions in Hong Kong and the proposed listing of BABA on the Hong Kong Stock Exchange.

However, the trade worked out perfectly and has gone up about 8% since purchase.

All that being said, both of these trades are long term holds so I shouldn’t be too excited over these early gains.

Going Forward

Going forward the market continues to look stretched which makes finding good long investments more difficult.

We did get a small pullback on the first trading day of December when trade war concerns resurfaced. However, it wasn’t long before rhetoric turned bullish again.

Personally, I wouldn’t be surprised if there is a trade deal and then markets sell off anyway. A buy the rumor sell the news type event.

November Performance Update

The goal of this project is to prove that anyone can become a millionaire by investing a regular amount into the stock market (not just blindly investing in index funds). So far I’m pleased with how it’s going.

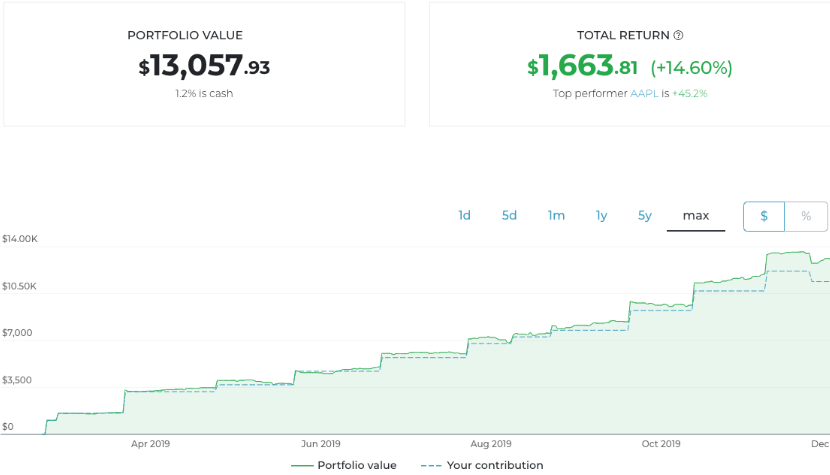

We are still a long way from $1 million but our total equity for the project now stands at $13,057.93 for a total return of 14.60%.

This is significantly better than if we had invested in the index every month which would have given us a return of 8.03%.

Like last month, I have a feeling the market will pull back soon. That should be OK because I have put aside some extra cash to take advantage of market weakness.

As the chart below shows, our equity continues to grow although it did dip as I withdrew some idle cash from my Apple sale. This money will be reinvested on a market pullback.

Overall the portfolio is looking nice and healthy and the return is better than the benchmark of 8.03%.

Hi,

What broker are you using?

I am using a NZ broker called Hatch powered by Drive Wealth.