Microcap stocks are great for day traders and swing traders because of their volatility.

But I wanted to know how well they perform on longer timeframes.

In this article we analyse a decade of performance data to see what you can expect from investing in microcap stocks.

Data Preparation

To do this analysis we will be using historical data for the Russell Microcap Index provided by Norgate Data.

The data goes back to July/August 2008 and has been organised so that we know when a stock enters and exits the index.

This is important because it eliminates survivorship-bias and creates a realistic environment for our test. Delisted stocks are replaced annually and IPOs added quarterly.

What To Expect From Investing In Microcap Stocks

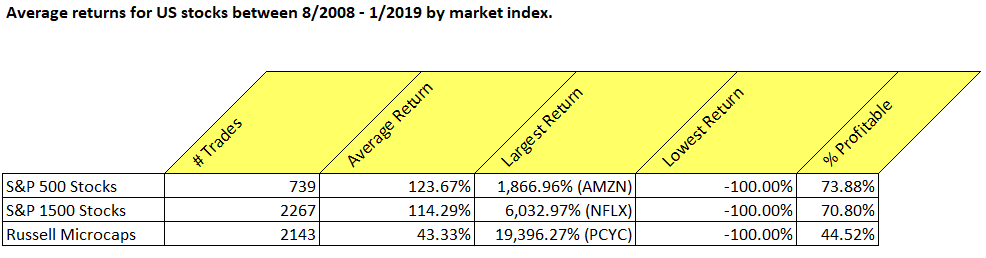

The next table shows the average buy and hold return for US stocks between 8/2008 and 1/2019.

I’ve chosen to show the average returns categorized by index so we are looking at S&P 500 stocks, S&P 1500 stocks and Russell Microcap stocks:

(NB: The Russell Micro Cap Index is maintained by FTSE and it generally consists of 1500 of the smallest companies excluding OTC stocks).

As you can see, the average return from buying a stock from the microcap index between 8/2008 and 1/2019 was 43.33%.

This compares to a 123.67% average return for a stock from the S&P 500 universe and a 114.29% average return for a stock from the S&P 1500.

Win Rates

Whereas 73.88% of investments in S&P 500 stocks finished in profit, more than 55% of micro cap investments ended as losers.

It’s clear from these numbers that you are more likely to get a profitable return from buying a stock in the S&P 500 or S&P 1500 than you do from investing in a microcap.

However, the microcap universe was responsible for the best performing stocks in our analysis.

Largest Returns

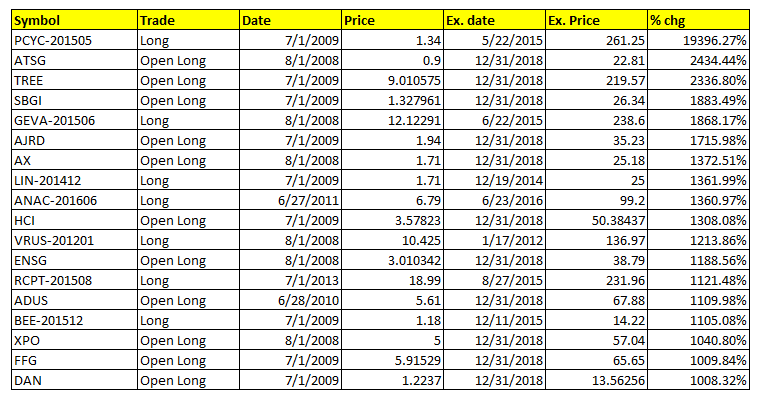

The biggest winner from the microcap universe was Pharmacyclics (PCYC) which produced a staggering return of 19,396.27%.

The company was bought out in 2015 by ABBV for $21 billion.

The table below shows that 18 microcap stocks gained more than 1000%:

Meanwhile, the largest return in the S&P 500 was AMZN (1866.96%) and the largest return in the S&P 1500 was NFLX (6032.97%).

Pharmacyclics (PCYC)

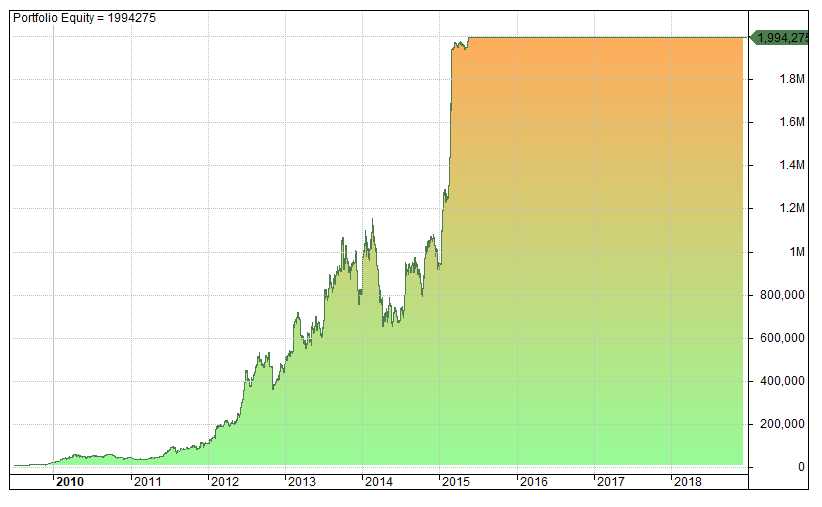

PCYC (below) produced a return of 20,000%:

If you’d managed to invest $10,000 in PCYC in July 2009 you would have ended up with almost $2 million by the time the company was bought out in 2015.

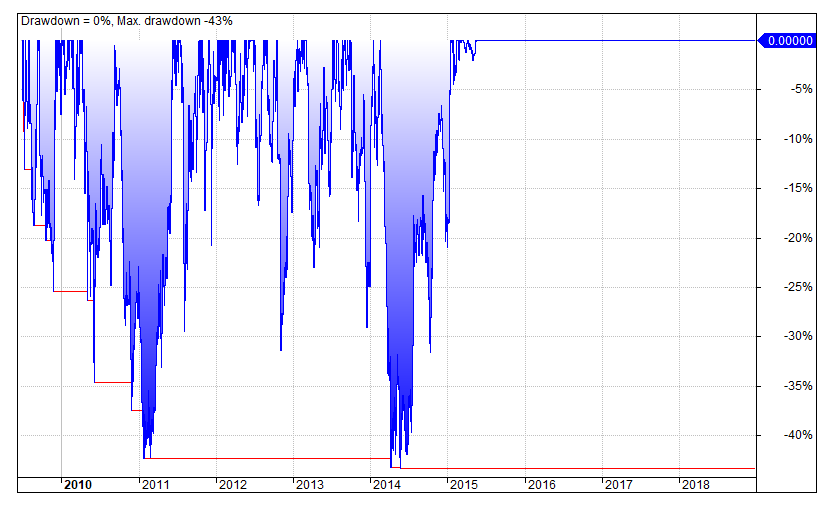

You would have also had to sit through two -40% drawdowns:

Finding A Ten Bagger

Although the micro cap universe did produce a number of high performing stocks, the difficulty is finding those from all the stocks available.

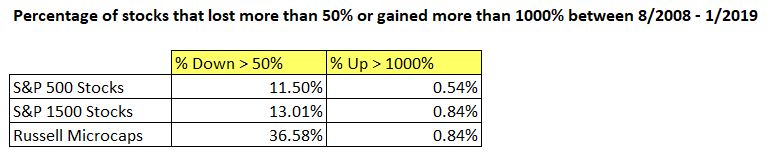

As the below table shows, less than 1% of Russell Microcaps returned more than 1000% over the time period while 37% lost more than 50% of their value:

In addition, 422 micro cap stocks (roughly 20%) lost more than 90% of their value while 406 stocks gained more than 100%.

If you compare the results above to the S&P 500, you can see that 0.54% of S&P 500 stocks returned more than 1000% but only 11.5% lost half their value.

Meanwhile, 0.84% of S&P 1500 stocks gained more than 1000% and 13.01% lost more than 50%.

Conclusions

The micro cap space is comprised of a diverse array of companies and provides interesting opportunities for investors.

They’re generally less researched than larger stocks so there is more opportunity to find an edge. Microcaps also provide access to early stage companies which are growing faster than larger stocks.

However, microcaps are also regarded as highly volatile and our research backs this up.

Our analysis shows that over the space of roughly 10 years, 37% of micro cap stocks lost more than 50% of their value while less than 1% were ten baggers.

This will always be the big difficulty for microcap investors – there are potential huge winners in the micro cap universe but the chance of finding them is small.

The prevailing wisdom that microcap stocks are volatile and most end up losing money is proven to be fairly true.

Final Thoughts On Microcap Stocks

Long term investing in microcaps is tricky and akin to playing the lottery.

That is why we don’t recommend a buy and hold approach for these securities.

We do have some micro cap strategies on our program but we utilize a short-term approach and try to capture quick trends rather than buy and hold.

Our backtested strategies perform a lot more strongly with this trend following approach.

Charts produced with Amibroker using data from Norgate.