In this article I look at some interesting new research from Haoyu Xu that can be useful for both momentum investors and reversal traders.

The research finds that morning returns positively predict next month returns (momentum) while afternoon returns negatively predict next month returns (reversals).

Reversal, Momentum And Intraday Returns

Intraday traders know full well that the largest moves of the day happen at the open and prior to the close. Indeed the first and last hours of trading now account for more than 50% of the daily volume in the US stock market.

However, until recently there hasn’t been much research that uses intraday moves to predict further out future returns.

A recent study by Haoyu Xu called Reversal, Momentum and Intraday Returns has come up with some interesting research that suggests there is a strong link between future returns and what happens during the first two hours and last two hours of trading.

Xu theorizes that a large portion of trades that occur in the first two hours of trading are motivated by information whereas a large portion of trades that occur in the afternoon are motivated by liquidity. As a result, the information that can be derived from these two periods is markedly different.

First Two Hours Vs. Last Two Hours

According to the author, pre-market trading offers limited liquidity for large traders to take positions and as such, when the market opens these large traders aim to position themselves based on overnight information.

In turn, this rapid trading creates momentum and the strength of that momentum can be seen to be a predictor of future returns when measured over the next 30 days.

Xu also suggests that trading that occurs in the last two hours, has an inverse relationship with future returns. He says that trades that occur at the end of the day are largely motivated by funds attempting to reposition their suboptimally allocated portfolios. As a result, we commonly see a reversal in trade compared to what we saw in the morning.

This reversal effect is so strong that there appears to be an inverse and profitable relationship between the closing two hours returns and future returns over the following 30 days.

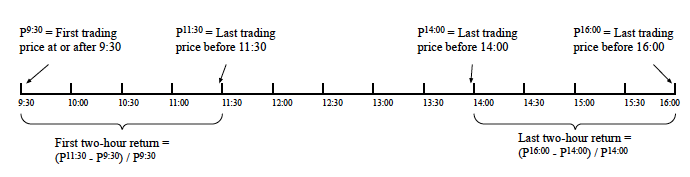

src: Xu, Haoyu, Reversal, Momentum and Intraday Returns (April 30, 2017).

Study Results

Xu studies all US listed stocks that are above $5, between 1993 and 2014 in this comprehensive study. He then selects the top ranked stocks based on the cumulative returns of both the morning (first two hours) and afternoon (closing two hours) sessions to see if there is any effect from separating out the two.

The results show that monthly accumulated morning returns and afternoon returns actually predict future returns in opposite directions over the next 30 days.

Xu then constructs typical momentum and reversal strategies in order to test the profitability of these findings.

Reversal strategies were shown to produce an alpha of 0.59% based on afternoon returns and a negative alpha of -0.74% on morning returns – consistent with the author’s theory.

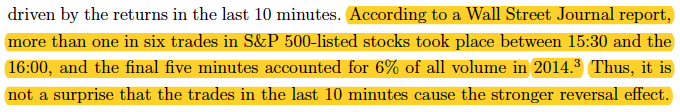

Furthermore, reversal strategies were found to work even better when based on the final one hour, half hour and even last ten minutes of trading.

Meanwhile, momentum strategies were shown to produce an alpha of 0.53% on first two hour returns superior to those from final two hour returns.

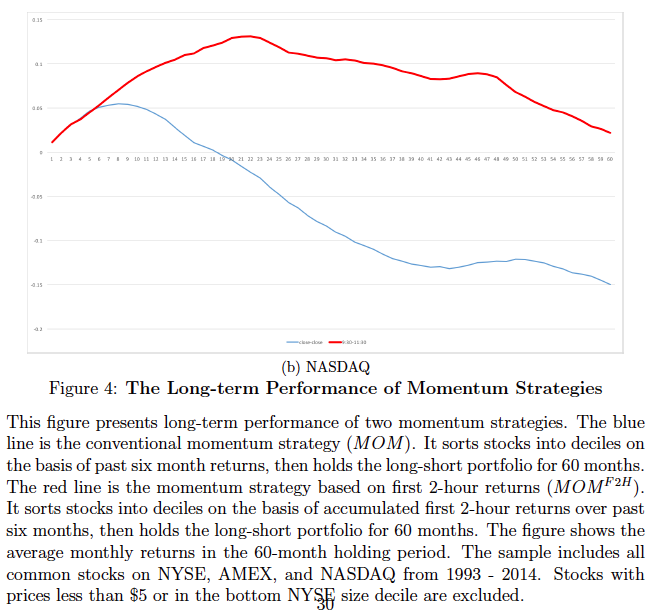

Even better, using a momentum strategy based on first two hour returns performed better than some traditional momentum strategies that simply use raw close-to-close returns to determine momentum.

In fact, the author’s momentum strategy based on morning returns was able to find longer lasting trends and was shown to reduce drawdowns by 60% compared to a conventional momentum strategy during the 2008 crash.

Below shows the performance of the authors momentum strategy based on morning returns (red) versus a more conventional momentum strategy based on close-close returns (blue):

What Can We Learn From This Study?

For traders and investors there are quite a few key takeaways from this study.

The first is that the trading day is not evenly suited for all trading styles.

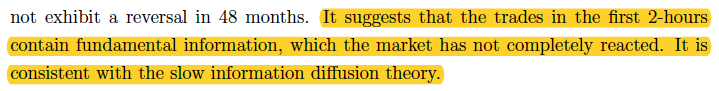

The opening two hours are driven by informed trading and is therefore the most susceptible to momentum. It is this period that likely carries the most amount of useful information for investors to analyse.

The middle period sees a significant reduction in activity and predictability where the best strategy is to not trade at all. Many traders, myself included, will know this from experience – it can be very costly to trade in and out when the market is not moving.

The closing two hours are driven more by liquidity and the rebalancing of open positions and is therefore more susceptible to reversal trading. Such reversals are seen to intensify during the last 10-30 minutes of trading and will be more prevalent in smaller cap securities.

The second takeaway is that there is the potential to gain an edge by focusing on what happens in the first two hours of trade in relation to price action during the rest of the day.

If a particular stock shows strong momentum during the first two hours, that stock is likely a better buy than a stock that only showed momentum in the middle or closing period.

Meanwhile, stocks that typically show strong direction heading into the close are likely to reverse and move in the opposite direction over the next 30 days.

Putting It Together

The insights gained from this paper can be used to construct long/short stock portfolios that are based on measuring accumulated morning or afternoon returns.

The study can also help improve existing momentum or reversal strategies.

For example, next time you have to choose between two momentum stocks on your watchlist, consider opting for the stock that has shown the best performances during morning trading as opposed to closing periods. It seems that the first two hours of trading carries most of the information for investors.

Conversely, when looking for reversal stocks consider directing your attention to those stocks that typically fall in the final two hours of trading.

Conclusion

In conclusion, investors need to not just examine raw close-close returns over the last 30 days, but rather dig deeper and look at cumulative returns during both the opening two hours of trade and the final two hours prior to the close to get a better picture of those stocks that are going to perform best going forward.

It’s clear that studying the intraday returns of different stocks can reveal key information about future returns.

It would be interesting to run some back-tests on this and see if similar results can be obtained perhaps in Amibroker or python. If anyone is interested in such a project, please email me or leave a comment below.

Hi JB,

This is a fascinating angle on momentum/reversal strategies. I’ve long been curious about the “seasonality” of intraday behavior and how institutional money is deployed at different times. What’s interesting is that the conventional wisdom that I’ve generally heard about the stock market in particular is that the first hour of trading is “dumb money” and should be disregarded, while the last hour is “smart money” and should be looked at closer. This paper suggests that it’s more complex than that.

I’d love to see if this concept could be demonstrated in a backtest. If I can get the hourly stoc price data, I may try it out in Amibroker (I use python for other things, but haven’t tried it for backtesting, but may give that a shot).

Hi Irfan,

Thanks for your comment.The reason I mention python is that you can access 1-minute stock data using zipline through Quantopian. I’ve been trying to get to grips with it but it’s a bit different to what I’m used to.

Do you have a good source of intraday data for Amibroker? Let me know if you have any success backtesting this, would love to see what you find. I will look into it as well.

I wish I had programming skills because I’d be in. But I’ve seen this phenomenon day trading ES futures. And with futures you can test even earlier. I suggest looking at returns from 8am Eastern through for the next 3.5hrs, or through the day, but ending 15min before the close. It seems like the sharpest sell offs start quite late, and the strongest all day trend days will only stutter out very late too. Would love to see a future article digging deeper on this. But for now this article gives credence to some discretionary things I do now

Hi Rob

Absolutely, I have witnessed this in futures as well. Will hopefully be able to take a closer look using more granular data at some point.