REIT stands for Real Estate Investment Trust. That’s a company that owns or operates income-generating real estate. REITs are exchange traded, so they can be bought and sold like other financial instruments such as stocks. An investor in a REIT can expect a regular dividend and exposure to the real estate market.

In comparison to other ways of investing in real estate (i.e. purchasing a house directly), REITs are diversified and liquid. Investors therefore face low transaction fees. Also, depending on the location, there can be tax advantages.

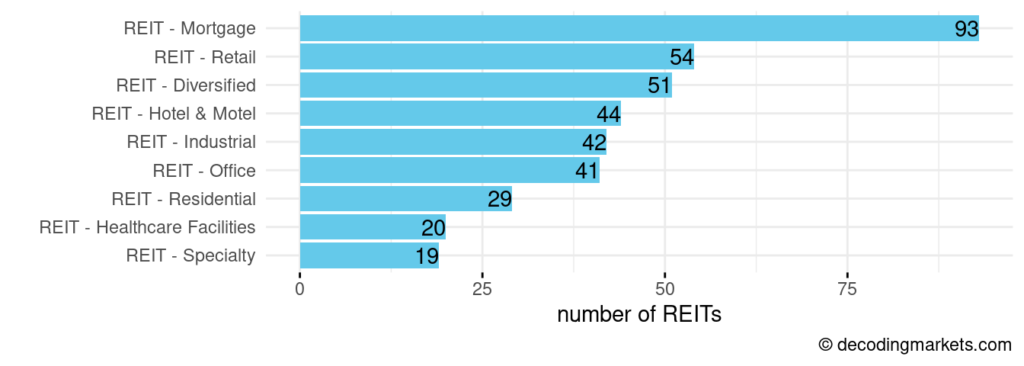

Commonly, REITs directly own and operate properties. As of today, there are 300 (directly owning) REITs listed in the US. These REITs are subdivided into retail, industrial, hotel/motel, industrial, office, residential, healthcare facilities, specialty, and diversified.

Specialty REITs may own properties that do not fit into the typical categories such as casinos, theaters or agricultural land.

The second main category are Mortgage REITs (also “mREIT”), of which we currently count 93. These provide financing for income-producing real estate such as shopping centers, offices, or apartment buildings by underwriting or purchasing mortgages, or by investing into mortgage-backed securities (MBS). The income earned is the interest on these financings.

A good resource for finding out more about REITs is the website of NAREIT (National Association of REIT), reit.com.

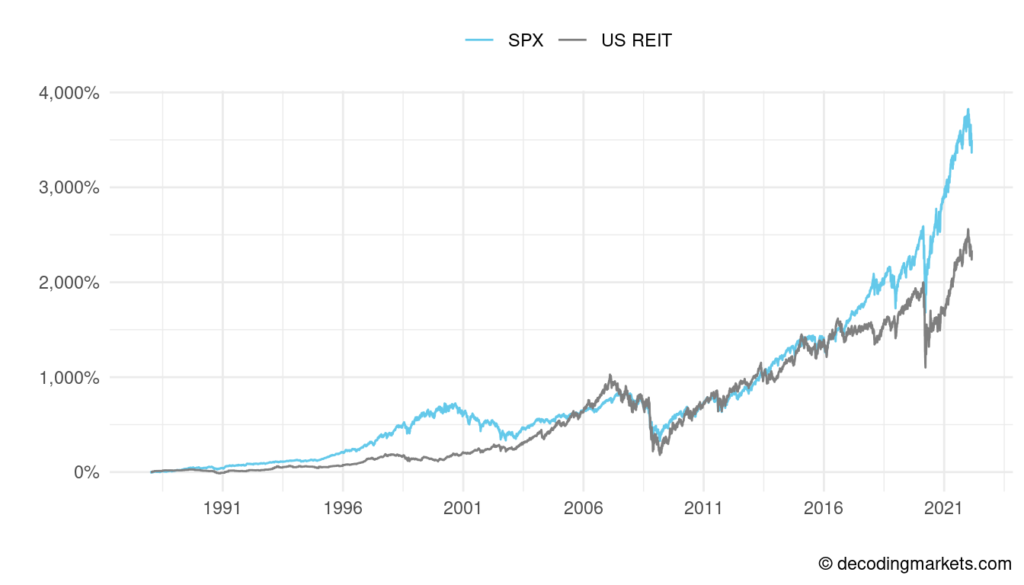

Below is a chart of the Wilshire US REIT index in comparison to the S&P 500 TR (SPX). A period that stands out is the run up to the financial crisis (2007/08), where the index peaked in 2006. We also see that REITs did quite well recovering from the lows of 2009, and after the 2000 correction.

Interest Rates And Inflation Matter

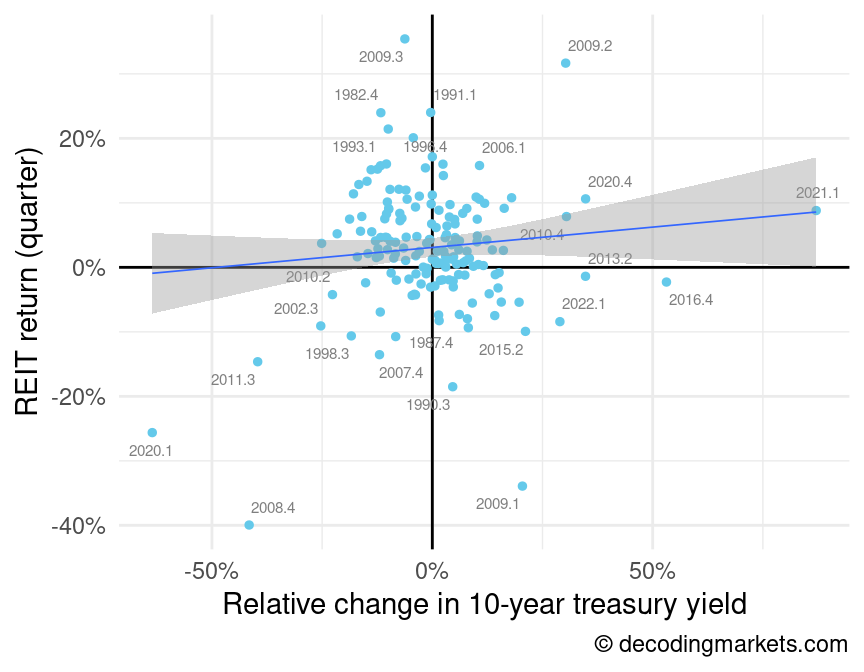

The value of real estate is highly dependent on interest rates. On paper, higher interest rates translate into lower real estate prices, as financing costs increase. On the other hand, lower interest rates lead into higher prices, as it becomes cheaper to finance properties.

However in reality, this price-interest relationships is over-simplistic. In fact, interest rate increases are often driven by economic prosperity, which in turn supports the growth of REIT earnings, in turn increasing the demand and price of REITs.

An analysis by NAREIT shows that REITs have performed positively even with rising long-term interest rates. This analysis is based on quarterly returns since 1992.

The following general statement is likely to hold true: While the economy is growing, REITs rise along with interest rates. On the other hand, in a slowing economy, and interest rates rising due to monetary tightening, REITs are more likely to suffer from interest rate increases.

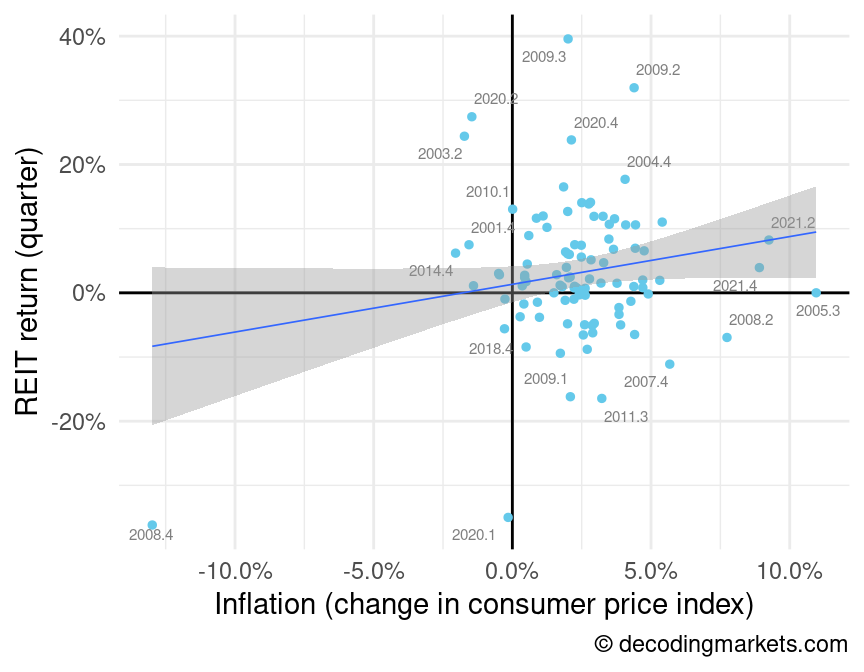

In the past, REITs’ returns could keep up with moderate inflation rates (NAREIT research). This is explained by the fact that long term lease contracts typically include a price level adjustment clause.

In summary, REITs do benefit from rising interest rates, given that the whole economy is doing fine. Even during times of inflation, REITs should continue to perform well.

What Type Of REIT To Invest In?

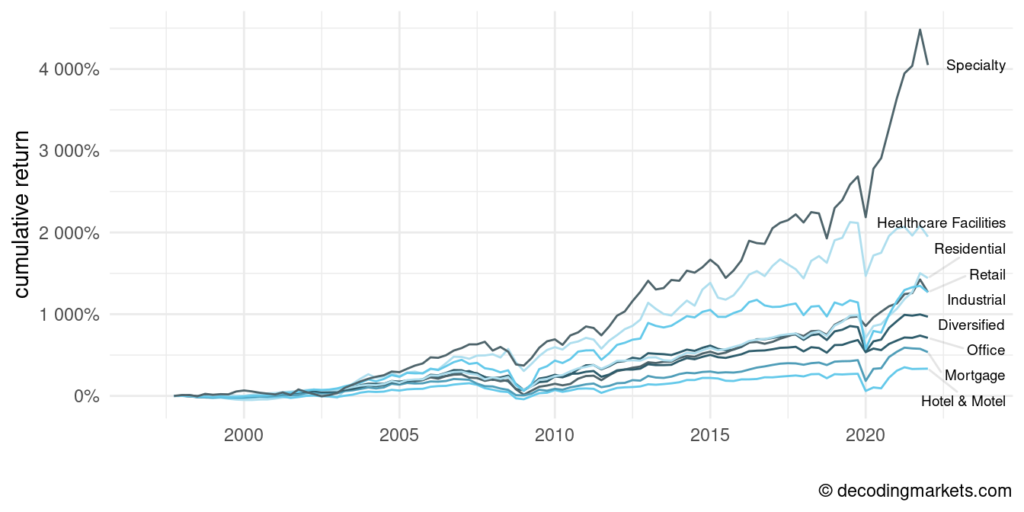

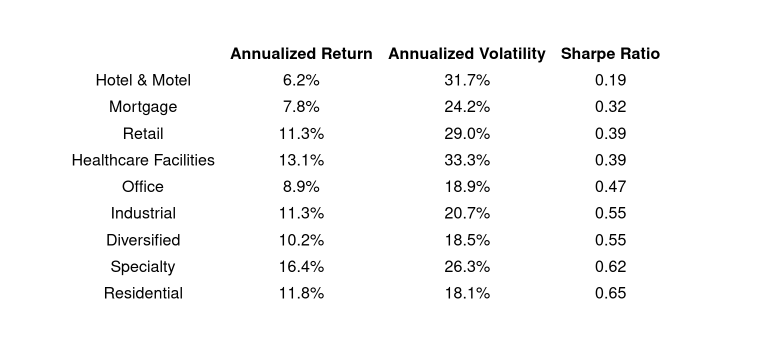

Below is a chart and summary statistics table for the performances of the main REIT categories.

You can see that Specialty REITS have sharply outperformed other categories. However, we must remember the smaller sample size in the Specialty category. Interestingly, residential, specialty, diversified, and industrial did the best in term of risk-adjusted returns (Sharpe Ratio).

Mortgage REITs performed the poorest, which could be explained by the low interest rates over the past 15 years and toxic assets during the credit crisis. In our opinion, one should be careful with mortgage REITs during times of rising interest rates, as they may own fixed-rate debt contracts which do not adjust in a higher interest environment.

Final Thoughts

There have been periods with exceptional returns in REITs (2002-2006, 2009-2016), which is of course no guarantee for future returns.

We have established that REITs can be a good investment, depending on the market cycle. In a growing economy, rising interest rates generally cannot bring down the performance of REITs. Also, REITs do not suffer from inflation at moderate levels.

The one case when REITs could do poorly, however, is when the Fed are tapering and thereby stalling the economy and/or causing a recession. There may be a small possibility of this happening if inflation rates go higher. Of course, anything that causes a recession can reduce the demand for housing and therefore the price of real estate.

Overall, REITs are an asset class to be included in a long-term portfolio. The main benefits are diversification and reasonably steady income.