The new course Hedge Fund Trading Systems Part Two is now open for enrolment. This course contains five new trading systems that I have developed.

Each system has been run on robust historical data and shows a consistent, profitable edge in back-testing. The rules for each system are fully explained and the Amibroker source code is also provided.

The course also contains important lessons on back-testing, system development and my process for taking a system live.

Hedge Fund Trading Systems Part Two contains the following new systems:

System One – Follow The Money

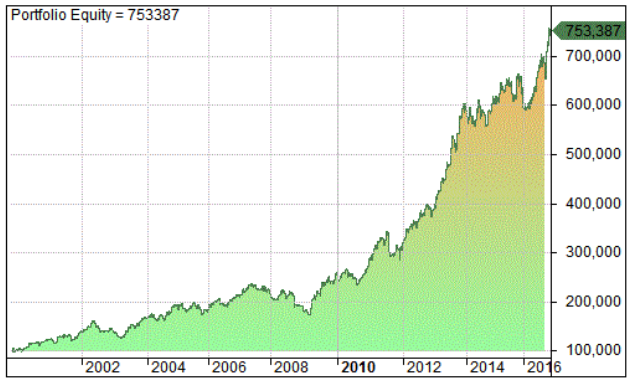

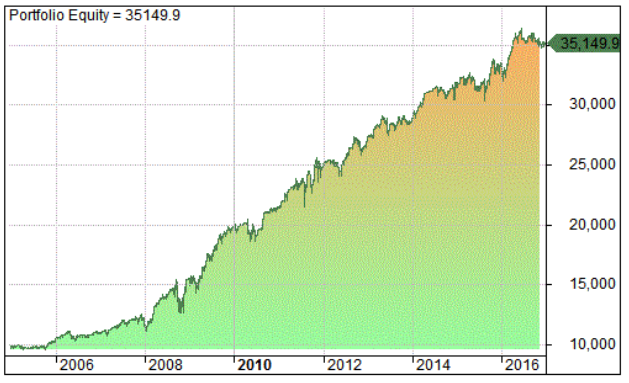

Follow The Money is a momentum type strategy designed for the S&P 600 small cap universe. It uses a combination of trend, volume and low volatility to find lasting trends on weekly timeframes.

Following is the equity curve for the system:

System Two – Nasdaq Pivots

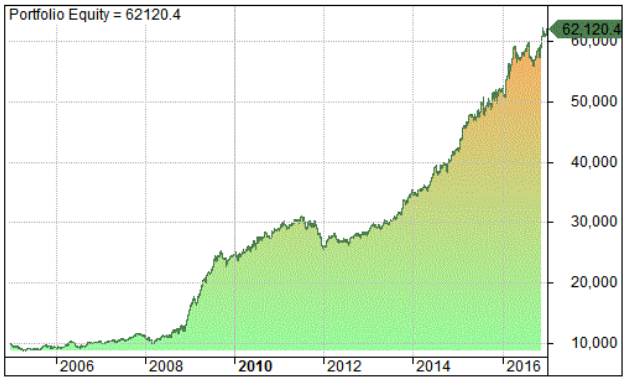

System two is a daily bar strategy that uses classic pivot points to find mean reverting entry levels. This is a short-term system that trades frequently and holds trades for one day. It is designed for Nasdaq 100 stocks but could be adapted for other markets.

Following is the equity curve for the system:

System Three – Shorting ETFs

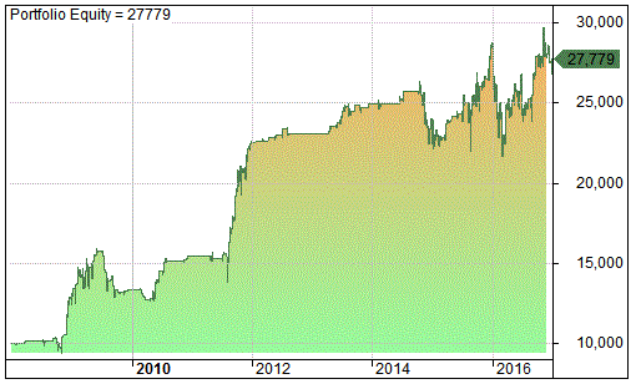

System three is another daily bar strategy that looks to short leveraged ETFs. The strategy seeks to profit from mean reversion and the time decay that exists in these structured products.

Following is the equity curve for the system:

System Four – E-Mini Dips

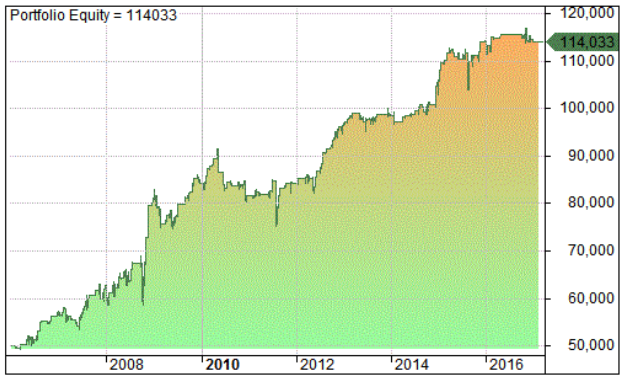

System four is a buy-the-dip type strategy which is based on a variation of a classic and proven oscillator system. It is designed for the E-Mini S&P 500 futures contract and the US Ten Year Note futures contract. This is the first futures system I have released and walk-forward analysis is used.

Following is the equity curve for the system:

System Five – Bar Strength

Bar Strength is a daily strategy that uses a simple technical indicator to find profitable swing trades. It also utilises a volatility filter to improve win rate. This system is back-test on 7 liquid ETFs and walk-forward analysis is also shown.

Following is the equity curve for the system:

Marwood Research

Members of Marwood Research Access All Areas receive complimentary access to this new course as part of their membership. That means Marwood Research now includes 9 premium courses and over 15 trading strategies!

Join Marwood Research Access All Areas Here

To summarise, Marwood Research now includes:

– Hedge Fund Trading Systems Parts 1 & 2

– The Big Volatility Short

– How To Build An Automated Trading Robot In Excel

– Candlestick Analysis For Professional Traders

– Value Investing Rules

– Trend Following Stocks

– Mental Models For Wall Street

– How to Beat Wall Street book & course

What you need to succeed in trading is not a course on Bollinger Bands or squiggly lines. You need a profitable edge. Marwood Research is designed to give you a profitable edge in the market with over 15 complete trading systems as well as lessons on psychology and how to automate those systems.

Thanks for sharing Joe! These systems look great, especially since they appear to be uncorrelated so there may be something for people regardless of market type or direction. Thanks again for sharing and I’ll definitely check out your course!

Absolutely, one of the criteria for making this course was to try and show uncorrelated systems as I know how important it is to be able to trade different markets and conditions and to combine strategies. It took quite a while to come up with five systems that I was happy with. Cheers.

Are these systems intended for algorithmic trading only using Amibroker or can be easily traded manually?

The systems are designed so that they can be implemented without the need for Amibroker. Most of the systems can be implemented using free (or at least low cost) charting tools. It’s advisable to run the systems on paper first to get comfortable with this process. So AB is used for back-testing but not used for actual trading. Thanks.

Hi JB, I attended you Candlesticks Course and look now for enroll some of yours new courses. I’m very happy about the quality end the level of knowledge you share in them. I started to look into Algo trading 8 months ago, and developed something in python and excel using intraday data, moslty 15m candlesticks. Do you have any kind of experience with intraday and in particular do you know if Amibroker is good with that? i use as data feed DTN iqfeed so theoretically should not be impossible to upload in Amibroker and handle them.

Hi Vince, thanks for your comment. At this time most of my research is focused on end of day trading so I only have limited experience back-testing on intraday time frames. Actually this is an area I will be looking into more closely over the next few months and I am planning on using IQFeed as well. I am sure that Amibroker will be more than capable. It already features a data plugin for IQFeed but I have not tried it out. What markets are you going to look at?