Stock research reports play a significant role in many investors’ stock selection process. Some use them to get trading ideas, while others, including professional asset managers, include or exclude stocks according to buy/hold/sell ratings.

Professional equity research is useful because you can only analyze so many stocks yourself. Condensed information in the form of equity research reports is therefore always welcome.

Complete research reports, which are generally handed out to direct paying clients of a financial institution, typically include a description of the investment case, a fundamental analysis, a price target, and a buy/hold/sell rating.

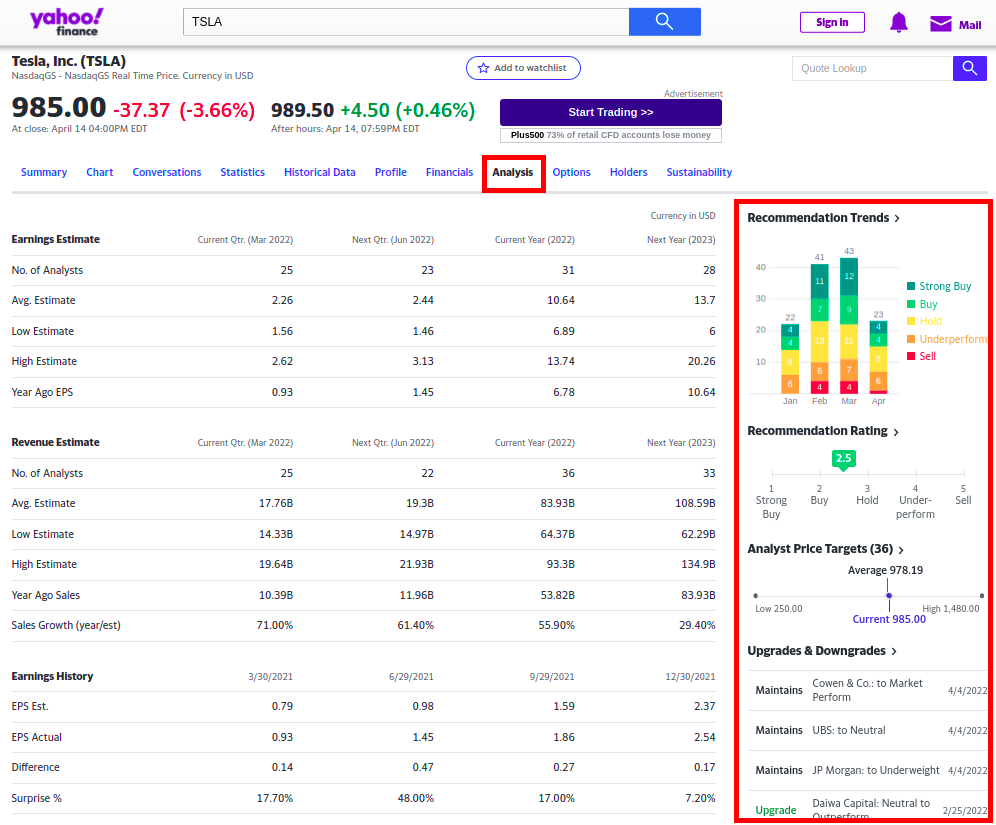

One can find aggregated information like price targets and recommendations in publicly available sources on the Internet. For example, on Yahoo Finance, under “Analysis,” you can see the earning and revenue estimates, price targets and up and downgrades.

The big question is what this information is worth. Do analysts really know better?

Data and Analysis

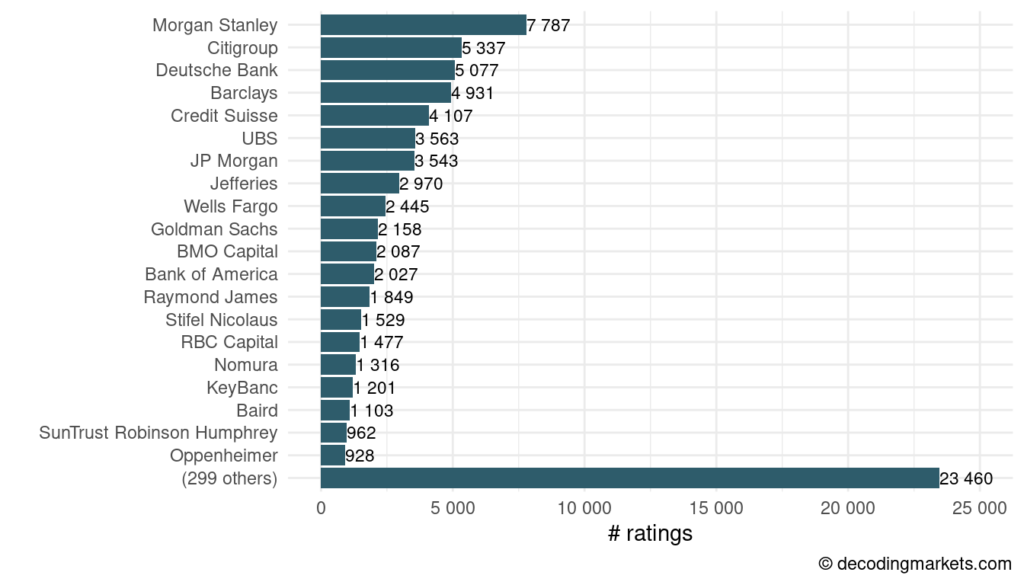

To answer this question, we gathered analyst recommendations on S&P 500 stocks since 2012. The dataset we came up with consists of almost 80 thousand ratings by over 300 rating institutions. Morgan Stanley, Citigroup, Deutsche Bank, and Barclays are responsible for the most recommendations.

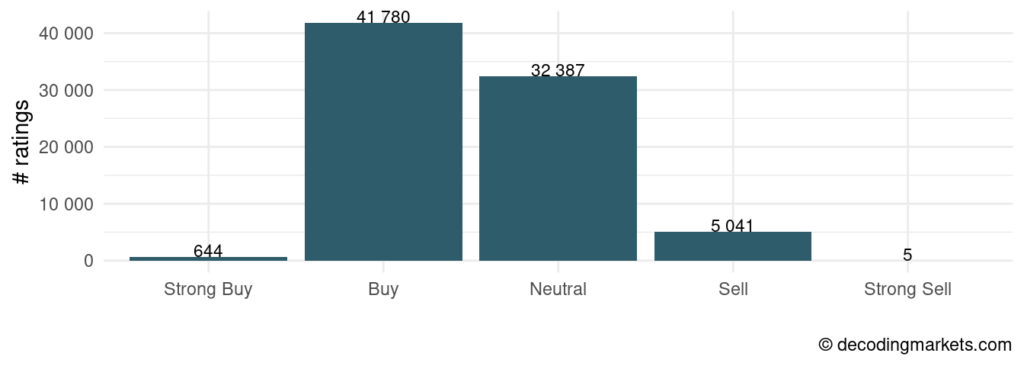

The vast majority are “buy” and “hold” (or “neutral”) recommendations with only a few “sell” ratings. The terms used include “overweight,” “market-weight,” “reduce,” “trim,” etc. It’s obvious what is meant.

The high conviction grades “Stong Buy” and “Stong Sell” are rare.

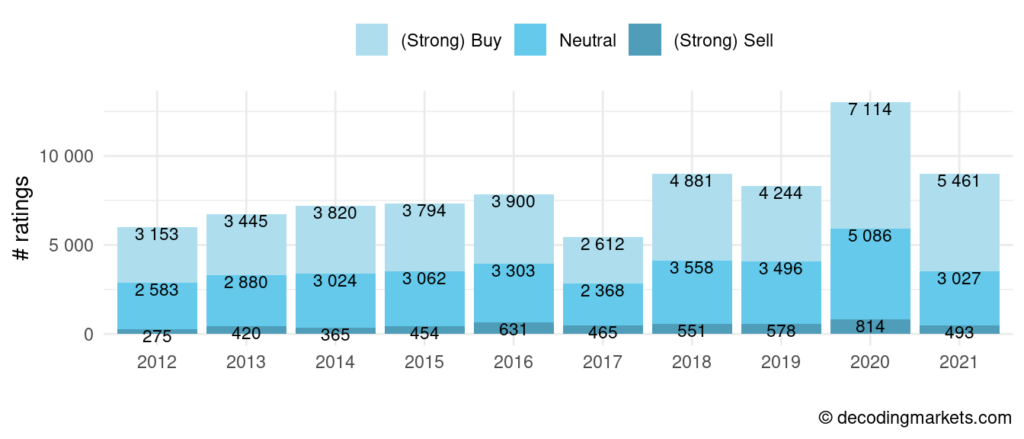

Overall, we observe an increasing number of ratings over the years with a drop in 2017 (for which we have no explanations). Possibly our data is slightly survivorship biased, but this should not be a major concern for now.

We take every rating and get the total return between the release day’s close and 21, 126, and 252 trading days after (1/6/12 months).

How did the Analyst do?

We would see superior average returns in “buy” than “neutral” rated stocks if analysts were more right than wrong. “Sell” rated stocks should clearly underperform.

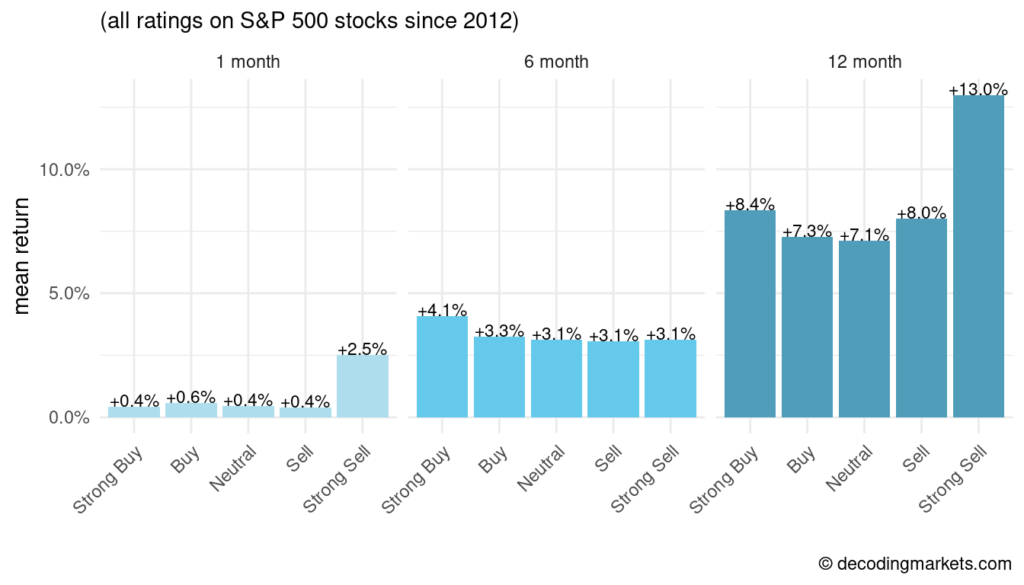

In reality, this is not the case, as shown in the following diagram.

The excess performance over six months from “buy” versus “sell” graded stocks is just 0.2%. Over 12 months, “sell” graded stocks even outperformed “buy” and “strong sell” even more so.

The remarkable better performance in the “Stong Buy” bin looks like a success. However, due to the small number (less than 1%), one should not pay too much attention to this.

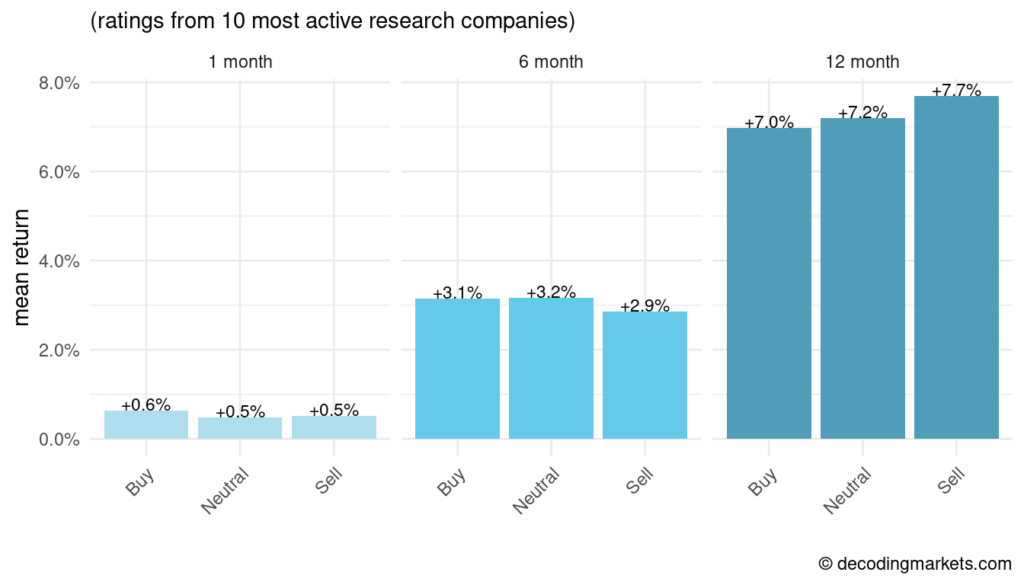

Interestingly, the picture looks even worse when filtering for the most active research companies (Morgan Stanley, Citibank, etc.)

Making Sense

By the way, we are not the first to find that analysts’ stock recommendations are poor. The question is, why this is the case.

It’s essential to understand that there are two types of research. Buy-side research for internal trading purposes is generally not given to outsiders. Our data is based on sell-side research. As the name implies, the idea is to boost trading activity. The majority of these analyses come to the same conclusion: “Buy.” Confident claims drive more action than cautious ones.

How do analysts arrive at their recommendations? Do analysts know more, or do they simply look further into the future than laypeople? It’s probably a combination of both.

But more importantly, the research conclusion also includes soft factors such as the analyst’s interests and preferences. As seen, there are far fewer pessimistic assessments. The analyst’s employer usually is interested in continuing to work with the company under review.

In addition, the researcher is also just a human being who often unintentionally decides “by instinct” and develops preferences for certain companies.

Besides the overoptimism, analysts’ recommendations often follow a counter-trend pattern. Intuitively, financial market professionals tend to have mean-reversal views (De Bondt 1993). This goes against the reality in which trends persist, and momentum strategies are profitable.

Final Thoughts

Instead of blindly trading according to analyst recommendations, it’s wiser to examine the arguments that lead to certain conclusions. If you have access to research reports, it’s worth paying attention to the factors that the analyst identifies.

It will help if you understand sell-side research for what it is: a marketing instrument.

There are trading strategies that can consistently make you money (trend following and others). Do your own research.

As a last mention, let’s list the current most favored stocks (as of mid-April 2022): SPGI, NKE, FANG, COP, and ADBE (all over 90% buy rated). The current least favored stocks are CLX, MMM, and FL (majority sell rated).

Given what we’ve seen, these recommendations are to be taken with a grain of salt.