I came across the following statement on social media that is attributed to the British economist John Kay:

It’s a myth that profits are higher in fast growing industries.

– John Kay

This is quite an interesting comment.

The past decade or so has seen a shift from value stocks into growth. I would argue one of the drivers of that shift is the belief that growth stocks have better margins.

It’s certainly true that strong performers like Facebook and Google have been able to grow profits without having to incur significantly large expenses.

Historically, these businesses have not been very capital intensive. But does this play out across the board?

Using data from Norgate and Reuters I analysed stocks from the US Russell 3000 to see if there is any relationship between gross margins and revenue growth.

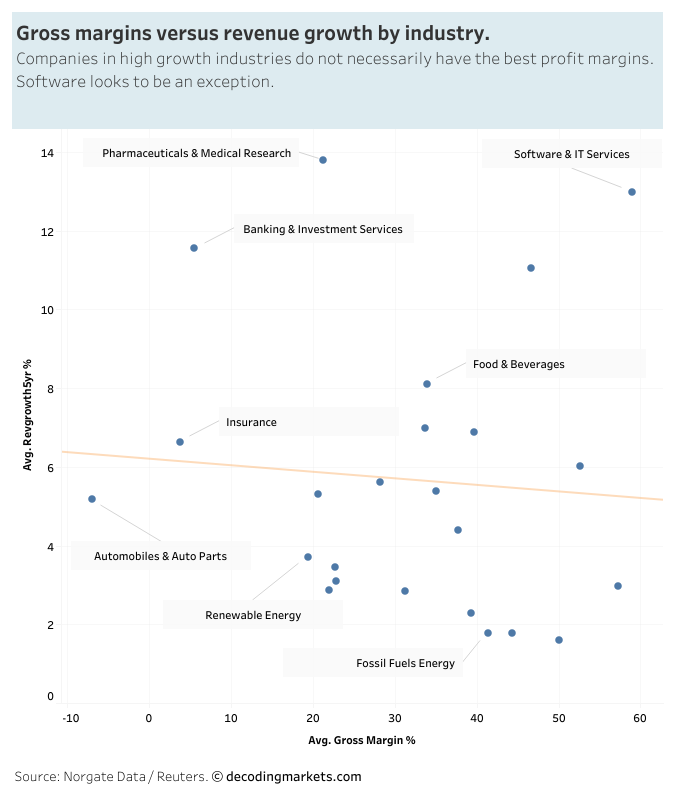

The chart below plots average gross margins against average 5-year revenue growth for various industries:

As you can see from the above chart, there isn’t much of a relationship between gross margins and growth.

If anything, fast growing industries have slightly lower margins.

That said, software is an exception. The industry shows average gross margins close to 60% and the second fastest revenue growth, around 13% on average.

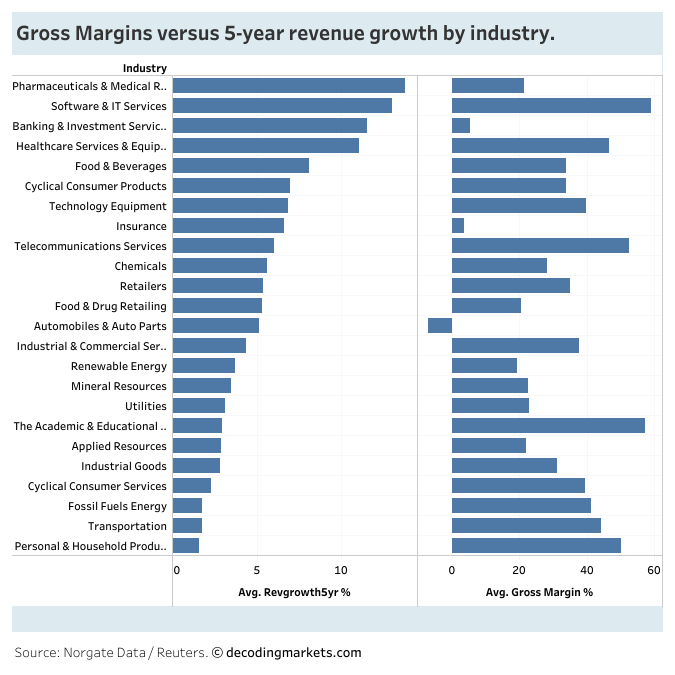

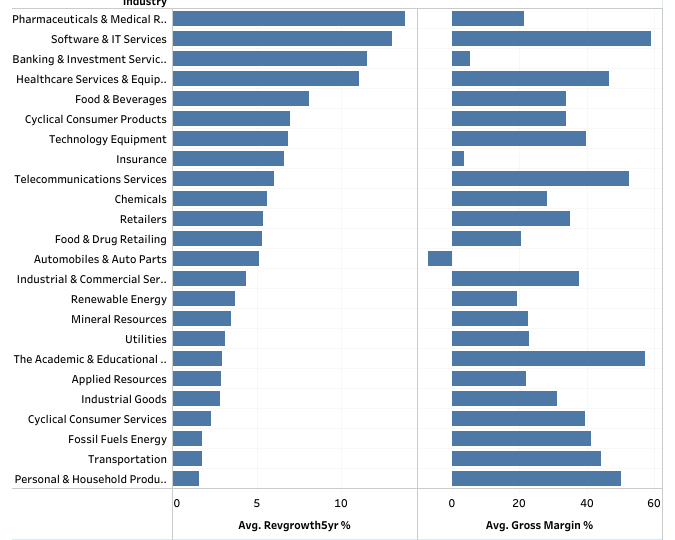

The table below provides a bit more depth to this data:

You can see that many slow growing industries possess strong margins such as fossil fuels and transportation. The truth is that fast growing companies with strong margins can be found across most industries.

How about valuation?

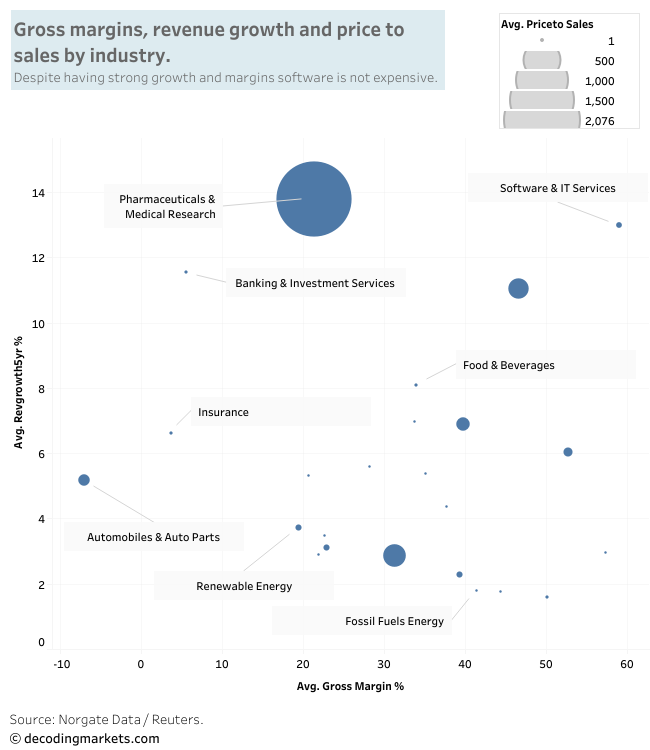

This final chart is the same as the first one except this time the size of the bubble represents the price to sales valuation for the respective industry.

The chart is a bit skewed by pharmaceuticals and medical research which has a sky high valuation because many pharma stocks have zero revenues.

However, an interesting finding is that software, despite having good margins and strong growth, is not valued that much more than other industries.

According to our data the software industry has an average price to sales of 12 compared to 2,076 for pharma, 16 for renewable energy, 4 for food and beverages and 2 for fossil fuels.

Insights

I think it’s fair to say that a company’s profit margins will generally change less than a company’s growth rate. This is because there are many factors that influence growth but fewer factors that influence the inherent characteristics of a business.

This insight might lead to some interesting ideas. For example, industries with high profit margins but low growth could become good investments if growth picks up.

Cyclical consumer services like travel or telecommunications companies might fit the bill here.

If a high margin telecom company is able to take advantage of the growth of 5G they could end up being good companies to own in the future?

Similarly, industries with strong growth but low profit margins might become good investments if margins increase. Here I’m thinking financials which are affected by changes in interest rates.

Lastly, software looks to be a good industry to be in with strong margins and strong growth.

Final Thoughts

Finding a company that exhibits fast growth and high profit margins could be described as the holy grail of investing. These stocks tend to provide handsome returns to early investors.

Our analysis shows that such companies are not limited to one industry. Fast growing companies with good margins can be found in all industries. The trick is to locate them and understand the forces that underpin those two factors.

There are always exceptions but fast growing industries do not necessarily make the most profits. John Kay’s statement appears to be true.