Regular readers will know that I started a new project last year called Zero To A Million.

The goal of this project is to prove that anyone can become a millionaire by investing a small amount into the stock market each month.

It’s also to prove that there are viable alternatives to index funds and you don’t need to follow the herd into low-cost ETFs. Yes, you can invest in individual stocks.

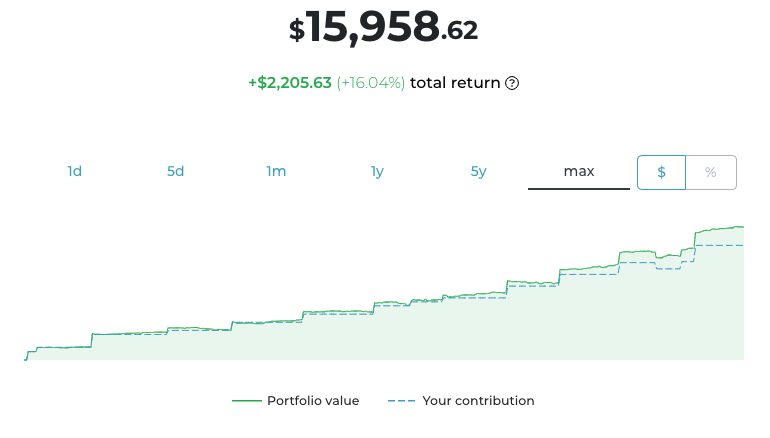

The project has been going well so far and we’ve managed to hit almost $16,000 in equity by investing an average of $1250 each month for a total return of 16.04%.

That is better than our benchmark and rounds out an excellent year for the ZTM project.

What Happened In December?

We were fortunate to get a mini dip right at the start of December which coincided with news that a US-China trade deal might be off the table.

I wasn’t quick enough to catch the market bottom so my first purchase of the month was a brand new position in Starbucks Corp (SBUX) on December 9th.

Still Growth Ahead For Starbucks

Obviously Starbucks is a huge, multinational company with a strong history of growth behind it.

But I still feel Starbucks has a bright future. The company has managed to grow revenues in 9 of the last 10 years (without too much debt) and the stock was trading below 20 times EBITDA at the time of purchase.

One of the reasons I like Starbucks is that the stock sold off around 20% during the tail end of 2019 partly due to competition from the likes of Luckin Coffee (LK), the Chinese coffee shop.

However, the FT reports that Luckin Coffee’s success has come largely from price discounting and outlet growth fueled by debt. This business model is risky and could backfire. So the narrative that Starbucks is losing the battle for China is probably overdone.

Overall, and the main reason and I bought Starbucks, is that it is a high quality business. It has plenty to like about it such as economies of scale, brand and other feedback loops.

It has a high quant score, ticks all the boxes for my long term portfolio and I was happy to enter at $86.31 per share, a 13% discount to the 52-week high.

The stock has since gained 2.92% since entry:

Taking A Bite Out Of Chewy

Chewy Inc. is an ecommerce business that caters for pet products, pet medicines and other animal products.

I was first alerted to the stock via an interesting article in the Wall Street Journal so decided to take a closer look.

The company has managed to grow revenues from $900 million in 2016 to more than $4.5 billion on a trailing twelve month basis.

The company is further branching out with its own pet products and animal pharmacies which seems like a smart move.

Although EBITDA is still negative the business trades at only 2.5 times revenue which is lower than most of the other hot-shot IPOs that surfaced in 2019.

The reasoning for this trade is that Chewy has been unfairly put in the same basket as other over-priced IPOs and, in fact, Chewy has a good shot at being able to double its market cap to $20 billion over the next few years.

I also like the fact that pet businesses tend to be resilient during economic recessions which could come in handy during this part of the market cycle.

Overall, Chewy doesn’t tick all the boxes for a long term position just yet but I felt there is enough potential to take a punt.

I already have several blue chip stocks in the portfolio so I was happy to buy a smaller stock with higher growth potential.

I purchased a portion of shares at a price of $26.50 and the position has since advanced 10.72% since purchase:

End Of Year Performance

It has been an excellent December and an excellent first year for the Zero To A Million portfolio.

Starting in February 2019, we have invested an average of $1250 a month and gone from a starting balance of zero to $15,958.62. That represents a total return of 16.04%.

If we can carry on at this rate we will be able to hit a million dollars in approximately 16 years.

This return is also 65% better than our benchmark. If we had invested the same amount into the SPY each month we would currently have an equity of $15,084, a return of only 9.68%.

To put these numbers in perspective:

- If you had invested only $600 a month with our strategy you’d now be sitting on roughly $7,659. At this rate it would take you just over 20 years to reach one million dollars.

- If you’d invested $2000 a month with our strategy you’d now have roughly $25,529. At this rate you’ll hit a million dollars in only 13 years.

We currently hold a total of 13 high quality stocks and ETFs (some of these purchases were detailed in other posts) and we also have some cash on hand in case of a market pullback.

What’s In Store For 2020?

As we move forward into 2020 I will continue to update the ZTM project and invest into one or two high quality stocks each month.

Markets, particularly US stocks, are certainly not cheap at this juncture and priced at 10% earnings growth for the first quarter implies there could be disappointment on the cards.

However, it is impossible to predict what the future will bring and we need to only focus on the long term process. Furthermore, there are always opportunities to be found in global markets.

If we keep investing into a selection of high quality businesses our returns should smooth out and grow over time.

This is an ultra long term portfolio and I’m very happy with how it’s going so far. If you would like to find out more about the details of this strategy you can sign up here.