First off, a few updates.

You may have noticed that this website now has a shiny new name, Decoding Markets!

The old one, jbmarwood.com, was too ambiguous and made me sound like an author of fantasy novels.

Decoding Markets reflects the new direction that I want this blog to go in.

It’s not about me, it’s about the markets and coming up with new ideas so we can all become better investors.

That’s why I will continue to develop new strategies, write new blogs and produce new courses on this platform.

To that end, I have just updated our free historical data section and also added a new trading strategy called Trading By The Book.

Zero To One Million Challenge

Another update is that earlier this year I started a new challenge which I am tentatively calling ‘Zero To One Million’.

This is a project where I am attempting to hit $1 million in equity through the process of investing a small amount each month into one to four different stocks.

At first, I will be investing $1000 – $1500 each month though this amount will fluctuate depending on what’s happening in the market and how much cash I have left to contribute.

To be specific, this is a long term strategy that I have backtested extensively using a method that randomly selects stocks.

However, instead of selecting stocks at random I am using a part quant/part discretionary method that I hope will enable me to do much better than random.

In a few weeks time I will publish a much more detailed guide that shows you exactly how this strategy works.

For now, I will detail the two stocks that I bought in August and my thoughts behind them.

To be sure, this is the ultimate long term portfolio and the goal is not to sell a holding unless absolutely necessary.

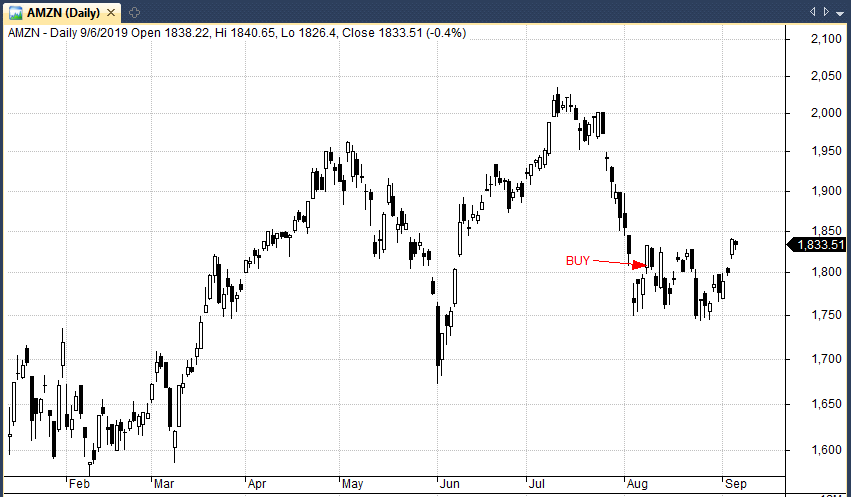

1. Amazon (AMZN)

I usually deposit my money for this project at the end of the month and make my stock purchases then.

However, after the S&P 500 dropped sharply in the first week of August, I decided it would be better to act quickly and take advantage of the volatility.

So my first purchase of the month was in Amazon which I acquired at a price of $1809, roughly a 10% discount to the 52-week high.

As I mentioned earlier the idea of this portfolio is to buy stocks that should be good for the long term, i.e, the next 10 to 20 years. Therefore I don’t need to do too much explaining as to why Amazon is a good choice.

The company has tremendous revenues and cash flow, economies of scale, a strong brand, a great history and impressive management.

Therefore, the most pressing question is whether or not the price is low enough to guarantee a future return.

Following are a few metrics courtesy of Seeking Alpha (as of 8th Sept):

Key Stats

- Enterprise Value: 937.11B

- EBITDA: 33.11B

- P/E: 76.07

- EV/EBITDA: 28.30

- EV/FCF: 40

- PEG: 0.84

- P/B: 17.07

- P/S: 3.57

- Gross Profit Margin: 41.27%

- ROE: 27.47%

- Total Debt/Equity: 134.97%

At first glance these metrics points to an inflated valuation.

I wouldn’t normally buy a stock that is trading at 28 times EBITDA or 40 times free cash flow as most companies will not be able to sustain those levels.

However, Amazon growth trends are high enough that PEG is still attractive with a score of 0.84.

In fact, if you use EV/EBITDA instead of P/E (which is 28.3) and take the five year historic EBITDA growth (52.47%) then the PEG is only 0.54.

So ultimately we have a high valuation in AMZN but a relatively low PEG.

This valuation is certainly touch and go and I would have loved to see a bigger price drop than what we got.

However, at the end of the day, Amazon is a high quality business which fits all of my other criteria and I don’t mind paying a little extra for a high quality business.

I also feel that quality large caps could be one of the best plays right now since both stocks and bonds (as a whole) are elevated.

The price for AMZN was a bit more than I would have liked but I felt that this was a reasonable enough opportunity to pick up some shares.

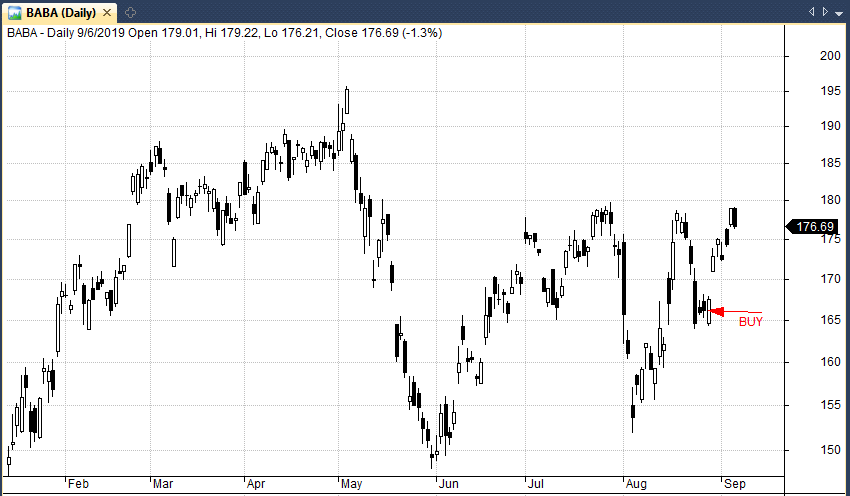

2. Alibaba (BABA)

You could say that BABA is the Chinese version of Amazon so it’s ironic that I also purchased Alibaba this month.

However, Chinese shares have been under pressure following all the trade war talk and I felt that this was a good opportunity to invest in another high quality business that has strong earnings, strong cash flow and impressive growth.

The metrics below actually bear a lot of similarities to Amazon (bear in mind that these numbers were slightly more attractive when I purchased the stock since it has already moved higher by 6%):

Key Stats:

- Enterprise Value: 465.22B

- EBITDA: 17.14B

- P/E: 32.96

- EV/EBITDA: 27.15

- EV/FCF: 43.11

- PEG: 0.44

- P/B: 6.05

- P/S: 7.78

- Gross Profit Margin: 46.37%

- ROE: 16.52%

- Total Debt/Equity: 21.85%

Like AMZN, valuations are on the high side but this is offset by a host of qualitative factors and impressive growth with a PEG of 0.44.

I bought 3 shares at an average price of $166.44 which was around 15% below the 52-week high.

Once again, the idea is that this is a long term position that I won’t need to touch for 10-20 years. So far the trade is looking good as the stock has already climbed 6%.

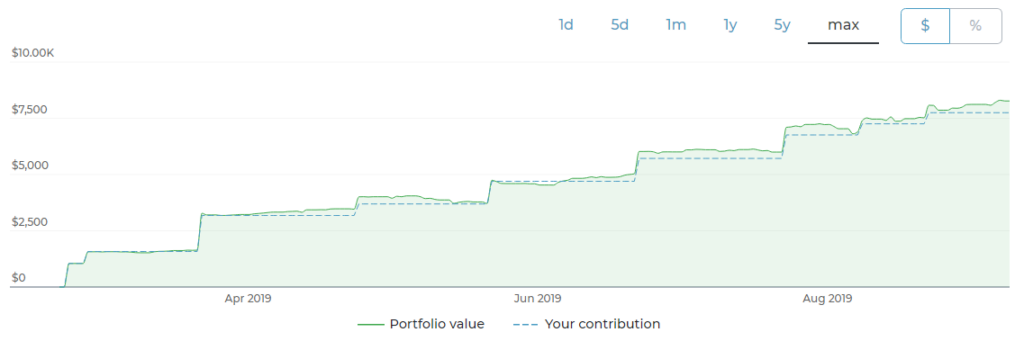

August Performance Update

As I mentioned above, the challenge is to build a $1 million portfolio by investing $1000 – $1500 a month into a diversified selection of quality stocks.

Starting in February 2019, I have so far invested a total of $7,750 across 9 different stocks for a gross return of $521. Our equity now sits at $8271 which equates to a total return of 6.72% which is beating the benchmark 4.07% return.

(The benchmark is the return that would have been achieved through investing the same amount in SPY each month).

The goal is to do better than SPY by investing in individual equities and to prove that anyone can become a millionaire by investing a small amount each month.

It’s going to take some time but so far I’m very pleased with how it’s going.

I’m sort of doing the same thing. I’m 41 and I’d like to reach financial freedom in ten years or so, so I started investing $1,000 per month last year with the intention of reaching $1 million. I’ll be reading along with great interest.

Cool, hope you are going well with it. Shame we didn’t start earlier eh? Good luck!