Whatever your investing style it’s useful to have a way to whittle down the thousands of available stocks to a more manageable number.

Over the years, I’ve listened to many investors explain how they do it. Often, the first step is to look at the Wall Street Journal for stocks near 52-week lows or 52-week highs.

But which is better? In this article I will analyse 11,000 US stocks over 30 years to see if it’s better to buy 52-week low stocks or 52-week high stocks.

52-Week High Stocks Vs 52-Week Low Stocks

Using historical data from Norgate and the backtesting software Amibroker I conducted a simple experiment to see if it’s better to buy stocks making new 52-week highs or 52-week lows.

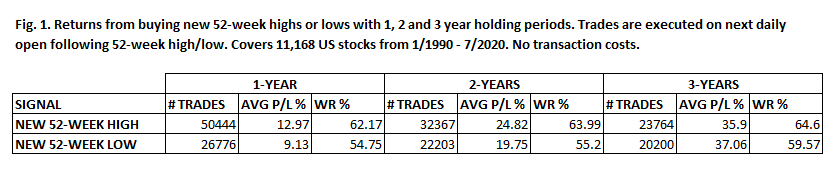

Figure one, below, reports the average profit per trade and win rate from buying new 52-week lows or 52-week highs with holding periods ranging from 1-year to 3-years.

These results are based on an analysis of 11,168 US stocks from 1/1990 – 7/2020. The data does not include very illiquid stocks or transaction costs and is survivorship-bias free:

As you can see from the table above, buying 52-week highs was a superior strategy to buying 52-week lows across most holding periods.

With a holding period of 1-year, stocks purchased at 52-week highs produced an average profit per trade of 12.97% with a win rate of 62.17% based on a sample of 50,444 trades.

Meanwhile stocks purchased at 52-week lows produced an average profit per trade of only 9.13% with a win rate of 54.75% based on a sample of 26,776 trades.

52-week highs were also superior with a 2-year holding period. 52-week low stocks produced a slightly better average profit over a 3-year holding period (albeit with a lower win rate).

20-Week Highs Vs 20-Week Lows

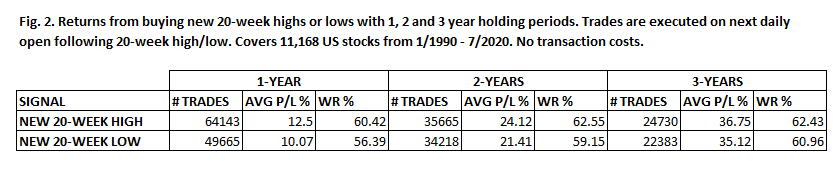

In case it might be better to use a shorter breakout length we can also test to see whether it’s better to buy 20-week highs versus 20-week lows. This is shown in figure 2 below:

Just like we saw when analysing 52-week low stocks, you can see that the better strategy is to buy new highs and not new lows. In fact, buying new highs produced better results over every holding period.

Better Across The Board

As it happens, by running the analysis over a broad range of values it’s clear that buying new highs broadly outperforms buying new lows in the US stock market.

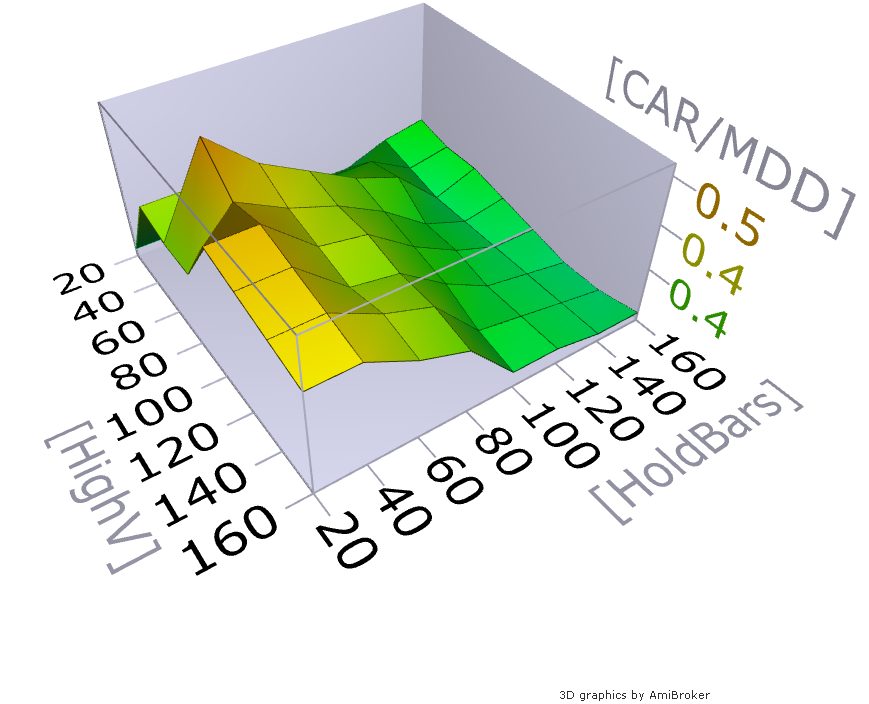

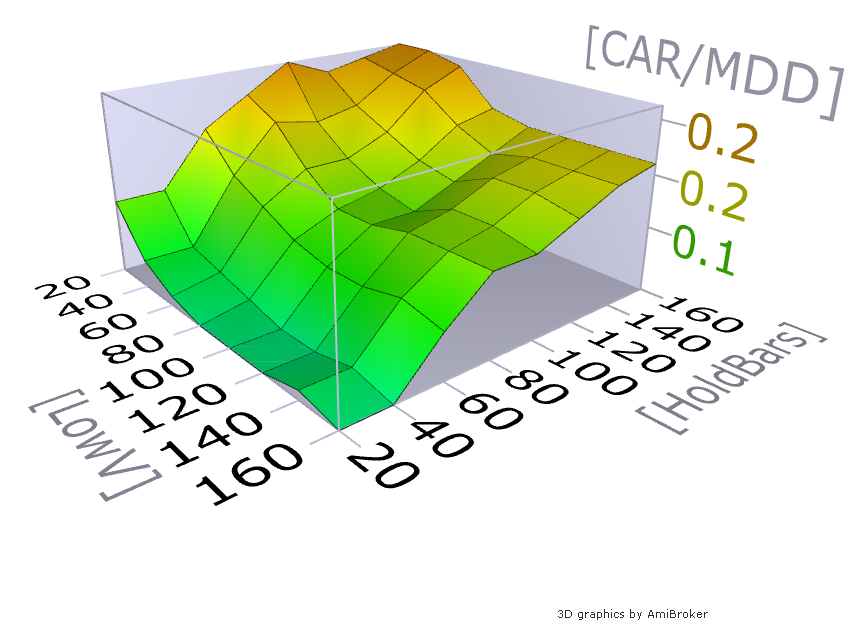

Using risk-to-return (CAR/MDD) as an objective metric we can run an optimization and see how new highs consistently gets better returns than new lows.

The charts below show risk-to-return plotted against holding period and breakout length in steps of 20. In other words, we are testing breakout lengths from 20-160 weeks and holding periods also from 20-160 weeks.

Figure three shows the optimization results for buying new highs and figure four shows buying new lows.

Fig. 3

Fig. 4

The charts show our optimization results in three dimensions so that we can see how returns change according to the different parameters.

It is enough to see that buying new highs produces better return-to-risk (CAR/MDD) across the board than buying new lows.

While buying new highs (fig.3) generates return-to-risk values in the range of 0.3 – 0.5, buying new lows (fig.4) generates values in the range of 0.05 – 0.25. Therefore, it is clear to see that buying new highs is superior across the board.

Interestingly, the sweet spot in the stock market seems to be a 60-week high with a 40-week holding period.

For new lows, performance starts low and appears to get better with holding length. But returns are never large enough to support buying new lows ahead of new highs. Buying stocks at all-time lows is a similar story. Stocks in downard trends do not make better investments than those in upward trends, even if they are considered ‘cheaper’ or better value.

What To Make Of This?

These results help us to answer whether it’s best to buy new highs or 52-week low stocks. Effectively, winning stocks or losing stocks. Tthis is important because investors often gravitate towards one or the other.

Psychologically, it is easier to buy a stock hovering around new lows than it is new highs.

That’s because a stock that has pulled back to a new low has a frame of reference (the previous high) that makes it easier to believe the stock is cheap (or at least cheaper than it was).

This could well be a type of anchoring or framing bias. The human mind becomes anchored to the previous high.

Conversely, a stock at a brand new high has no such reference for comparison. It is sailing in uncharted water and so it’s harder to believe that the stock is good value.

The Data Is Clear – Avoid Stocks Near 52-Week Lows

But the data is clear about what works best.

Over the years, I have read many trading books and articles where investors give different opinions as to which is better, 52-week highs or 52-week lows.

I have seen value investors that begin their search by scanning lists of 52-week lows in the WSJ as they are looking for stocks that are considered ‘cheap’.

I have also read academic journals which claim winning stocks produce better short-term returns but losing stocks produce better long-term returns.

Our analysis has proven that both of these ideas are false.

Across a range of different values, it’s clear that buying new highs is a better strategy than buying new lows.

A stock that is at new lows is more likely to be fundamentally damaged than a stock that is near new highs.

It is harder to pull the trigger on a stock making new highs which, ironically, makes them better opportunities for investors to pursue.

Hi Joe, just wondering if you meant it like its stated, when commenting on 3D charts from Amibroker you say sweet spot is 60 WEEKS high with 40 WEEKS holding, whereas in the text above you define the scale as 20-160 days, so in that case your comment on sweet spot would be clearly out of chart. Thank you for explaining. Kind regards, Marek

Yes I mean weeks not days, thanks.

Nice study Joe. I always like reading what you are up to!

Nice post Joe – it is always so much better to backtest and analyse based on what the data actually shows rather than market folk-law! Well done.

Should be worth watching the Crypto market based on this analysis. As it is a relatively new market when BTC breaks through the previous all time high ther is a 60% chance the price will drive on up until it eventually retraces at a time in the future.

I would say buy 160 day highs and sell after 20 days. I am a believer of 52-week New highs but I like to play “Devil’s Advocate”: the S&P 500 has spent more time trending up so no surprise of this. I wonder if this test was applied to European or Japanese equities. Just because it has not happened in US now.. it does not mean that US equities will continue to behave in the same way. Just being aware of other patterns in the world is a good thing. At least you can be mentally ready if and when it should happens.

The other thing is how the long trade develops in that 1 year holding period: it would be interesting to see the average volatity / dispersion of a 52 week new high buy and hold for 1 year. What the average 1-year long trade look like when you average all those 50,000 trades?

Finally, may I suggest reading “The 52-Week Low Formula: A Contrarian Strategy that Lowers Risk, Beats the Market, and Overcomes Human Emotion” book? Thank you

Better quality stocks are less likely to ever gave a 52 week low as the price keeps appreciating over time, and the opposite is true for worse quality stocks. It may be better to define better quality stocks and buy when they are low but not necessarily 52 week low.

Thank you Joe, for the interesting analysis!

Do you have reliable data for selling the 52-Week Lows?

With best regards

Udo

I haven’t done an exhaustive test but from previous experience I would guess it’s no better than break even.

Nice study. Wonder if the same would apply to ETFs or if when trading a basket of stocks instead of individual stocks buying the lows would be better.

That would be an interesting study.